4 Best Volatility 75 Index Brokers in Vietnam

The 4 best Volatility 75 Index Forex brokers in Vietnam revealed. We have explored and tested several prominent Volatility 75 Index Forex brokers in Vietnam to identify the 4 bests.

This is a complete guide to the 4 best Volatility 75 Index Forex brokers in Vietnam.

In this in-depth guide you’ll learn:

- What a Volatility 75 Index Forex broker is

- Who are the 5 best Volatility 75 Index forex brokers for traders in Vietnam

- The best strategies for trading the Volatility 75 Index in Vietnam

- Risk management techniques for Volatility 75 Index trading in Vietnam

- How to choose the best Volatility 75 Index Forex brokers in Vietnam

- Who are the best Forex brokers in Vietnam?

And lots more…

So, if you’re ready to go “all in” with 4 best Volatility 75 Index Forex brokers in Vietnam…

Let’s dive right in…

- Lesche Duvenage

Best Volatility 75 Forex Brokers in Vietnam

| 🏅 Forex Broker | 👉 Open Account | ✔️ Volatility 75 Broker? | 💰 Minimum Deposit? | 💸 Vietnam Dong (VND) Deposits Allowed? |

| HFM | 👉 Open Account | Yes | USD 0 / 0 VND | No |

| AvaTrade | 👉 Open Account | Yes | USD 100 / 2444503 VND | No |

| IC Markets | 👉 Open Account | Yes | USD 200 / 4889007 VND | Yes |

| IG | 👉 Open Account | Yes | USD 0 / 0 VND | No |

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

What is the Volatility 75 Index?

The Volatility 75 Index, popular among online traders in Vietnam, reflects market volatility. Tracked by the financial markets, it offers opportunities for traders to profit from price fluctuations. As a synthetic index, it represents a basket of assets, providing a dynamic trading environment with potential high returns, but also heightened risk.

4 Best Volatility 75 Forex Brokers in Vietnam

- ✔️ HFM – Overall, Best Volatility 75 Forex Broker in Vietnam

- ✔️ AvaTrade – Best Low Spread Broker

- ✔️ IC Markets – Top Regulated Broker in Vietnam

- IG – Best Broker for Beginner Traders

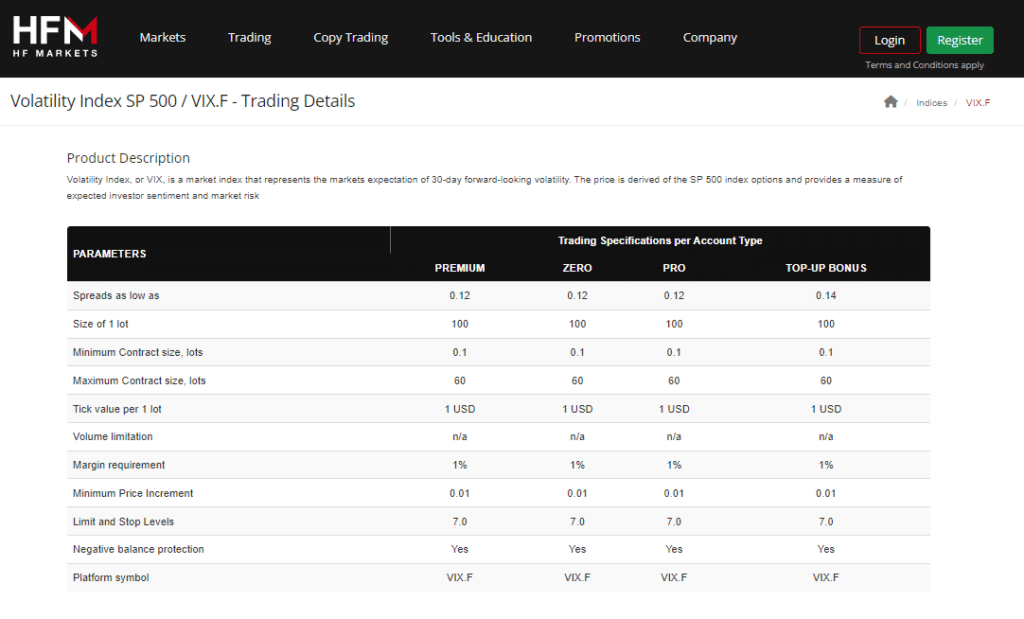

1. HFM

Overview

HFM is a leading Forex broker offering Vietnamese traders a robust platform for global financial markets. Renowned for its user-friendly interface and advanced tools, HFM enables seamless trading experiences.

Min Deposit

USD 0 / 0 VND

Regulators

FSCA, CySEC, DFSA, FSA, CMA

Trading Desk

MT4, MT5, HFM Platform (Android & IOS)

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Notably, it grants access to the Volatility 75 Index, catering to the preferences of Vietnam’s dynamic traders who seek diversified opportunities. With competitive spreads, a range of account types, and multilingual customer support, HFM stands out as a trusted choice.

The platform’s commitment to regulatory standards ensures a secure trading environment, fostering confidence among Vietnamese traders as they navigate the complexities of the financial markets.

Features

| Feature | Information |

| ⚖️ Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | 0 VND or $0 |

| 📈 Average spread from | From 0.0 pips |

| 📈 Maximum Leverage | 1:2000 |

| 👥 Customer Support | Yes |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The EUR/USD currency pair is actively traded because of its low minimum spread of 0.9 pips. | There are few deposit and withdrawal methods available to Vietnamese traders on HFM. |

| Traders of all levels of experience might profit from practising their craft on a virtual trading platform. | |

| Investors can trade in a wide variety of assets with HFM, and Vietnamese traders have simple access to the desktop, mobile, and web-based versions of the MetaTrader 4 and 5 platforms. |

2. AvaTrade

Overview

AvaTrade caters to Vietnamese traders seeking diverse investment opportunities. Renowned for its user-friendly platform and comprehensive services, AvaTrade provides seamless access to global financial markets.

Notably, Vietnamese traders can engage in dynamic trading with AvaTrade as it offers access to the Volatility 75 Index.

Min Deposit

USD 100 / 2444503 VND

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, ISA

Trading Desk

MT4, MT5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

This instrument allows traders to capitalize on market volatility. With a commitment to regulatory standards, competitive spreads, and multilingual customer support, AvaTrade stands out as a trusted choice for Vietnamese traders navigating the complexities of the Forex market while seeking opportunities in the Volatility 75 Index.

Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| ⚖️ SBV Regulation | No |

| ✔️Trading Accounts | Retail Account, Professional Account |

| 💳 Minimum deposit (VND) | 2444503 VND or $100 |

| 📈 Trading Platforms | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 📈 Trading Assets | Forex Precious Metals Stock CFDs Indices Individual Shares Cryptocurrency Energies Commodities |

| 👥 Social Media Platforms | Instagram YouTube |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade offers a comprehensive selection of more than 1,250 trading instruments across various financial markets. | AvaTrade does not offer variable spreads |

| The company has demonstrated its adherence to regulatory standards in several jurisdictions. | There are only two account options available for selection: a retail account and a business account. |

| Sophisticated investors have access to a diverse range of potent trading tools. | A monthly fee is assessed for accounts that are not active. |

| AvaTrade gives Vietnamese traders competitive trading conditions, as well as the option to open an Islamic account and a demo account for the purpose of familiarising themselves with the platform before to engaging in real money trading. | There could be charges related to the process of converting currencies. |

| Since its establishment, AvaTrade has been the recipient of multiple accolades, thereby garnering the admiration and endorsement of its clientele. | There could be charges related to the process of converting currencies. |

| AvaTrade offer a wide array of social trading choices and trading tactics that are accessible to traders in Vietnam. |

3. IC Markets

Overview

Since its inception in 2007, Australia has been home to IC Markets, which has licenses from some of the world’s most stringent regulatory bodies.

With over $15 billion in foreign currency transactions and over 500,000 orders completed daily, IC Markets is one of the major FX CFD providers in the world.

Min Deposit

USD 200 / 4889007 VND

Regulators

ASIC, CySEC, FSA, SCB

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Traders of all types and experience levels can easily benefit from IC Markets’ state-of-the-art trading platforms, which are the company’s claim to fame. Vietnam traders can also engage in futures, stock indices, and commodity trading in addition to foreign exchange.

Features

| Feature | Information |

| ⚖️ Regulation | ASIC, CySEC, FSA, SCB |

| ⚖️ SBV Regulation | No |

| ✔️Trading Accounts | cTrader Raw Spread Standard |

| 💳 Minimum deposit (VND) | USD 200 / 4889007 VND |

| 📈 Trading Platforms | MT4, MT5, WebTrader |

| 📈 Trading Assets | Forex Precious Metals Stock CFDs Indices Individual Shares Cryptocurrency Energies Commodities |

| 👥 Social Media Platforms | Instagram YouTube |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| IC Markets is a multi-regulated forex and CFD broker with a decent trust score and a low-risk reputation | There is a higher minimum deposit requirement charged than other brokers |

| There is real raw spread trading offered across several asset classes | Vietnamese traders could face currency conversion fees |

| IC Markets offers some of the best spreads in the industry | There are no fixed spreads offered by IC Markets |

| There is a choice between three different account types that suit different types of traders | |

| There are no hidden fees and IC Markets is one of the best options for high volume trading because it has a long list of liquidity providers | |

| There is a free demo account offered |

4. IG

Overview

IG Group extends its comprehensive services to Vietnamese traders, providing a tailored platform for their dynamic market. Renowned for user-friendly interfaces and advanced tools, IG Group empowers Vietnamese traders to navigate global financial markets seamlessly.

Notably, IG Group offers access to the Volatility 75 Index, allowing Vietnamese traders to capitalize on market volatility.

Min Deposit

USD 0 / 0 VND

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

With a commitment to regulatory compliance, competitive spreads, and multilingual support, IG Group stands as a trusted choice for Vietnamese traders seeking opportunities in Forex trading, including engaging with the dynamic nature of the Volatility 75 Index.

Features

| Feature | Information |

| ⚖️ Regulation | FCA, BaFin CySEC, FINMA, DFSA, FSCA, MAS, JFSA, ASIC, FMA, CFTC, NFA, BMA |

| ⚖️ SBV Regulation | No |

| ✔️Trading Accounts | IG Trading Account Limited Risk Account Islamic Account (Dubai traders only) Demo Account |

| 💳 Minimum deposit (VND) | USD 0 / 0 VND |

| 📈 Trading Platforms | MetaTrader 4 IG Platform ProRealTime (PRT) L2 Dealer FIX API |

| 📈 Trading Assets | Forex Indices Shares Commodities Cryptocurrencies Futures Options |

| 👥 Social Media Platforms | LinkedIn YouTube |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Traders from Vietnam who join IG have access to a wide range of trading tools and strategies. | Deposits are not free of charge. |

| Those of the Muslim faith can open Islamic accounts. | The Islamic account is open only to Dubai’s Forex traders |

| New traders are welcome to enroll at the IG Academy. | Withdrawals and deposits can only be made through a limited number of payment methods. |

| IG is a multi-jurisdictional online broker that provides its clients with access to a wide range of financial products. | Because the broker does not take VND, Vietnamese traders who make deposits in VND are charged a conversion fee. |

| IG has received one of the highest levels of trust in the country of Vietnam. |

Strategies for trading the Volatility 75 Index successfully in Vietnam

Trading the Volatility 75 Index demands a nuanced approach, particularly in the vibrant and dynamic market of Vietnam.

As traders seek opportunities in this instrument, understanding and implementing effective strategies becomes crucial for success. Here, we explore various strategies tailored for Vietnamese traders looking to navigate the dynamic nature of the Volatility 75 Index.

Trend Following Strategies

In the context of Vietnam’s evolving market, trend-following strategies prove valuable for Volatility 75 Index trading. Identifying and riding trends can be effective, considering the potential for prolonged periods of volatility.

Traders may use technical indicators like moving averages or trendlines to spot and follow trends, aligning their positions with the prevailing market direction.

Breakout Strategies

Breakout strategies involve capitalizing on significant price movements after a period of consolidation. In Vietnam’s dynamic market, breakout strategies suit the Volatility 75 Index, allowing traders to catch substantial moves.

Implementing this strategy involves setting buy or sell orders just beyond identified support or resistance levels, anticipating a breakout and riding the subsequent momentum.

Mean Reversion Strategies

Given the inherent fluctuations in the Volatility 75 Index, mean reversion strategies can be effective for Vietnamese traders.

This approach assumes that prices will revert to their historical average over time. Traders identify periods of extreme volatility and take positions anticipating a return to more typical levels. Technical indicators like Bollinger Bands or the Relative Strength Index (RSI) can aid in identifying overbought or oversold conditions.

News Trading

Vietnam’s economic landscape can be significantly influenced by regional and global events. News trading involves taking positions based on the impact of economic releases, geopolitical events, or market sentiment.

Vietnamese traders need to stay informed about local and international news that might affect the Volatility 75 Index. Quick decision-making is crucial when employing this strategy, as market reactions can be swift.

Options Trading

Options provide an alternative for Vietnamese traders seeking more sophisticated strategies. Strategies like straddles or strangles allow traders to benefit from expected volatility, regardless of the market’s direction.

Given the dynamic nature of Vietnam’s market, understanding and incorporating options strategies can add versatility to a trader’s toolkit when dealing with the Volatility 75 Index.

Scalping

In Vietnam’s fast-paced market, scalping can be an attractive strategy for Volatility 75 Index traders. This short-term approach involves making numerous quick trades to capitalize on small price movements. Traders need to be adept at technical analysis, using tight stop-loss orders and maintaining a disciplined approach to secure profits in a volatile environment.

Diversification

Given the unpredictable nature of the Volatility 75 Index, diversification can be a risk management strategy for Vietnamese traders.

Spreading investments across various asset classes or instruments can help mitigate the impact of sudden market swings. A diversified portfolio tailored to Vietnam’s market conditions provides a hedge against specific risks associated with the Volatility 75 Index.

Algorithmic Trading

As technology advances in Vietnam, algorithmic trading is becoming more accessible. Automated systems can execute trades at high speeds, responding to market conditions in real-time.

Traders can develop or employ algorithms that take advantage of short-term fluctuations in the Volatility 75 Index, aligning with Vietnam’s tech-savvy trading community.

Navigating the dynamic nature of the Volatility 75 Index in Vietnam requires a strategic and adaptive approach. Traders should align their chosen strategies with the unique characteristics of the Vietnamese market, considering factors like cultural nuances, economic dynamics, and regulatory environments.

By incorporating these tailored strategies, Vietnamese traders can better position themselves to capitalize on the opportunities presented by the Volatility 75 Index while managing the inherent risks effectively.

Risk Management Techniques for Volatility 75 Index Trading

Engaging in Volatility 75 trading in Vietnam’s dynamic market requires a keen understanding of risk management to navigate the inherent uncertainties. Effectively managing risk is paramount to sustaining long-term success and safeguarding investments.

Here, we explore essential risk management techniques tailored for Vietnamese traders involved in Volatility 75 trading.

Position Sizing

Vietnamese traders venturing into Volatility 75 trading should carefully determine the size of their positions relative to their overall capital.

Position sizing involves allocating a percentage of the trading capital to each position, mitigating the impact of potential losses on the entire portfolio. By limiting the exposure to any single trade, traders in Vietnam can protect themselves from significant drawdowns.

Setting Stop-Loss Orders

Implementing stop-loss orders is a crucial risk management tool. Traders in Vietnam should define predetermined exit points for each trade, restricting potential losses.

Adjusting stop-loss levels based on market conditions and volatility ensures a dynamic approach that aligns with the unique characteristics of Vietnam’s trading landscape.

Diversification

Vietnamese traders can spread risk effectively by diversifying their portfolios. Rather than concentrating on a single asset or strategy, diversification involves investing across various instruments and sectors.

This approach helps mitigate the impact of adverse market movements on the entire portfolio, aligning with Vietnam’s preference for balanced and diversified investments.

Risk-Reward Ratio

Calculating and adhering to a risk-reward ratio is crucial for prudent Volatility 75 trading in Vietnam. Traders should assess the potential reward relative to the risk in each trade.

A favorable risk-reward ratio ensures that potential gains outweigh potential losses, providing a strategic framework for making well-informed trading decisions.

Utilizing Trailing Stop-Loss

Vietnamese traders can leverage trailing stop-loss orders to secure profits while allowing for potential additional gains. This dynamic mechanism adjusts the stop-loss level as the trade progresses in the desired direction. Trailing stop-loss orders enable traders to lock in profits during volatile market conditions, a common feature in Vietnam’s fast-paced trading environment.

Regularly Reviewing and Adjusting Risk Parameters

Volatility 75 trading in Vietnam requires constant monitoring and adaptation. Traders should regularly review and adjust risk parameters based on changes in market conditions, economic factors, or geopolitical events. This proactive approach allows for timely adjustments to risk management strategies to align with Vietnam’s ever-evolving financial landscape.

Utilizing Hedging Strategies

In the face of market uncertainties, Vietnamese traders may consider employing hedging strategies to mitigate potential losses. Hedging involves taking offsetting positions to reduce risk exposure. While not eliminating risk entirely, hedging strategies can act as a safeguard, especially during periods of heightened volatility.

Stay Informed and Responsive

Staying informed about global and local market developments is fundamental for effective risk management in Volatility 75 trading in Vietnam. Traders should remain vigilant and responsive to news, economic indicators, and emerging trends. This proactive approach enables quick adjustments to risk management strategies in response to changing market dynamics.

Avoiding Overleveraging

Overleveraging is a common pitfall that traders in Vietnam should be wary of when engaging in Volatility 75 trading.

Excessive leverage magnifies both gains and losses, posing a significant risk to the trading capital. By maintaining conservative leverage ratios, traders can protect themselves from severe financial setbacks.

Seeking Professional Guidance

Vietnamese traders navigating the complexities of Volatility 75 trading can benefit from seeking professional guidance. Consulting with financial advisors or market experts familiar with Vietnam’s trading landscape can provide valuable insights and tailored advice for effective risk management.

How to choose the best Volatility 75 Index Broker in Vietnam

Vietnamese traders must evaluate the following components of a Volatility 75 Index broker to decide whether the broker is suited to their unique trading objectives and/or needs.

Regulations and Licenses

This is the first important component that traders must thoroughly evaluate. Reputable brokers are regulated by market regulators such as FCA, ASIC, CySEC, FSCA, and others. Vietnamese traders must beware when dealing with brokers that only have offshore regulations such as FSA, SVG BVI, FSC, and others.

Account Features

Account Features include leverage trading and margin requirement, commissions and spreads, initial deposit, additional features on retail investor accounts, and so on.

Deposits and Withdrawals

Vietnamese traders must evaluate the payment options available, the processing times on withdrawal requests, deposit currencies offered, the withdrawal fee, deposit fees, and minimum withdrawal limits among other trading and non-trading fees.

Range of Markets

The range of markets offered refers to the number and range of tradable instruments that the broker offers. Vietnamese traders must consider what they wish to trade and what is available.

Customer Support

Customer Support is another crucial factor and Vietnamese traders must check the availability of support (trading hours), the quality of support, and the promptness with which the customer support team responds to queries.

Trading Platform

A trading platform is the Vietnamese trader’s portal to the financial markets. Traders must ensure that the trading platform has the necessary technical indicators, fundamental analysis, technical analysis, economic calendar, charting, newsfeed, and other tools they may need.

Education and Research

Education and Research come in handy to both novice traders and experienced investors. Education includes some of the following:

- eBooks

- Trading guides

- Trading knowledge on leveraged products

- A risk warning on complex instruments

- Educational videos

Research can include some of the following:

- Trading tools

- Commentary

- Status of International Markets

- Price movements

- Market sentiments

- Whether there is a volatile market

- Exchange Rates

- Expert opinions and several other resources can help experienced traders make informed trading decisions.

The Best Forex Brokers in Vietnam

In this article, we have listed the best brokers that offer the Volatility 75 Index to Vietnamese traders. We have further identified the brokers that offer additional services and solutions to Vietnamese traders.

Best MetaTrader 4 / MT4 Forex Broker

Min Deposit USD 5 / 122225 VND Regulators FSC Trading Desk MetaTrader 4 Crypto Yes Total Pairs 48 Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Overall, Alpari is the best MT4 Forex broker in Vietnam. Alpari’s reputation as a reputable market maker makes it a popular choice for investors. Alpari ensures that its trades will be executed in a fraction of a second or less. Alpari currently has more than two million registered users.

Best MetaTrader 5 / MT5 Forex Broker

Min Deposit USD 100 / 2444503 VND Regulators ASIC, FSA, CBI, BVI, FSCA, FRSA, ISA Trading Desk MT4, MT5, Ava Social, Ava Protect, Trading Central Crypto Yes Total Pairs 55+ Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Overall, AvaTrade is the best MT5 Forex broker in Vietnam. AvaTrade has a solid reputation as a trustworthy and respectable broker in the CFD and FX trading markets. AvaTrade maintains separate accounts for customer funds at reputable financial institutions in the relevant jurisdictions.

Best Forex Broker for beginners

Min Deposit USD 10 / 244450 VND Regulators CySec, FCA Trading Desk No Trading Desk Crypto Yes Total Pairs 47 Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Overall, eToro is the best Forex broker for beginners in Vietnam. eToro offers a variety of educational materials to its users, including the eToro Academy, the eToro Plus paid membership program, and simulated trading accounts.

Best Low Minimum Deposit Forex Broker

Min Deposit USD 0 Regulators ASIC, BVI, CFTC, FCA, FFAJ, FSC, IIROC, MAS, NFA Trading Desk MetaTrader 4 (MT4), MetaTrader 5 (MT5) Crypto Yes Total Pairs 45 Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Overall, Oanda is the best low minimum deposit Forex broker for traders in Vietnam. All levels of currency trading experience are welcome to use Oanda’s cutting-edge trading platform.

Best ECN Forex Broker

Min Deposit

USD 5 / 122225 VND

Regulators

IFSC, CySec, ASIC, FCA

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Crypto

Yes

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation

24 Hours

Overall, XM is the best ECN forex broker in Vietnam. XM prioritizes several essential criteria, such as pricing, customer service, safety, and financial considerations.

Best Islamic / Swap-Free Forex Broker

Min Deposit

USD 100 / 2444503 VND

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, Tickmill is the best Islamic / Swap-Free forex broker in Vietnam. The brokerage firm Tickmill is well-known for its trustworthiness and honesty. A wide range of traders can profit from this brokerage firm’s services, which include various account options, competitive spreads, and reasonable pricing. Tickmill is currently accessible in a variety of languages and has been granted authorization to be used in a number of jurisdictions.

Best Forex Trading App

Min Deposit $10 / 244450 VND Regulators CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA Trading Desk MetaTrader 4 and MetaTrader 5 Crypto Yes Total Pairs 107 Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Overall, Exness offers the best trading app for traders in Vietnam. The Exness Trader app provides Vietnamese traders with a wide range of favorable features and functionality. Technical indicators, candlestick charts, and quantitative calculators are essential tools for building a firm foundation for trading success.

Best Forex Rebates Broker

Min Deposit

USD 100 (recommended amount USD 1000) / 2444503 VND

Regulators

FCA, CySEC, FSCA, SCB

Trading Desk

MT4

Crypto

Yes

Total Pairs

70

Islamic Account

Yes

Trading Fees

High

Account Activation

24 Hours

Overall, FxPro is the Best Forex Rebates Broker in Vietnam. FxPro serves as a financial middleman, offering its customers Electronic Communication Network (ECN) and Straight Through Processing (STP) services.

Retail participants in foreign exchange trading can get compensating returns in the form of rebates, up to a monthly maximum of 30%.

Best Lowest Spread Forex Broker

Min Deposit

0 USD / 0 VND

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes

Total Pairs

60+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, Pepperstone is the best lowest spread forex broker in Vietnam. The spreads available for trading the US dollar vs the euro with Pepperstone range from zero to 33 basis points. Pepperstone Markets is widely known in the market as a leading brokerage firm due to its vast track record of success.

Best Nasdaq 100 Forex Broker

Min Deposit

USD 0 / 0 VND

Regulators

IGRs

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

80

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, IG is the best Nasdaq 100 forex broker in Vietnam. IG has established itself as a strong contender among the top 20 platforms in Vietnam due to its powerful trading tools, diverse product offering, and favorable market conditions. IG, the industry’s leading online brokerage firm, does business in Vietnam. IG distinguishes itself from its competitors by strictly adhering to several regulations and offering a wide range of investing alternatives.

Best Volatility 75 / VIX 75 Forex Broker

Min Deposit

USD 200 / 4889007 VND

Regulators

ASIC, CySEC, FSA, SCB

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

65

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, IC Markets is the best Volatility 75 / VIX 75 forex broker in Vietnam. IC Markets is popular amongst traders in Vietnam for its strong commitment to transparency and its excellent trading conditions.

Best NDD Forex Broker

Min Deposit

USD 10 / 244450 VND

Regulators

FSC, FSA, FSCA

Trading Desk

MetaTrader 4

MetaTrader 5

Crypto

Yes

Total Pairs

83

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, BDSwiss is the best NDD forex broker in Vietnam. BDSwiss has established itself as a significant international provider and broker of CFD/forex services, with a monthly FX trading volume of €20 billion and a vast network of over 16,000 affiliate accounts.

Best STP Forex Broker

Min Deposit

USD 25 / 611125 VND

Regulators

FCA UK

Trading Desk

None

Crypto

Yes

Total Pairs

28

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, OctaFX is the best STP forex broker in Vietnam. OctaFX has received almost twenty-eight notable honors. OctaFX’s implementation of Electronic Communication Network (ECN) and Straight Through Processing (STP) techniques has resulted in a 33% reduction in trading expenditures.

Best Sign-up Bonus Broker

Min Deposit USD 0 / 0 VND Regulators FSCA, CySEC, DFSA, FSA, CMA Trading Desk MT4, MT5, HFM Platform (Android & IOS) Crypto Yes Total Pairs 50+ Islamic Account Yes Trading Fees Low Account Activation 24 Hours

Overall, HFM is the best sign-up bonus broker in Vietnam. HFM’s trading platform is well known and recognized for its competitive price and strong quality standards. The HFM website offers a diverse range of asset markets and account settings to suit users with varied levels of experience in foreign exchange trading.

Conclusion

Overall, trading with Volatility 75 Index Brokers offers Vietnamese investors a gateway to capitalize on market fluctuations. These brokers provide a tailored platform, enabling traders to implement diverse strategies while managing risks effectively.

You might also like: Best CFD Forex Brokers in Vietnam

You might also like: Best Forex Trading Apps in Vietnam

You might also like: Best Forex Trading Platforms in Vietnam

You might also like: Best High Leverage Forex Brokers in Vietnam

You might also like: Best Forex No-Deposit Bonus Brokers in Vietnam

Frequently Asked Questions

Why is the Volatility 75 Index popular among traders in Vietnam?

The Volatility 75 Index represents market volatility, and its popularity in Vietnam stems from the opportunities it offers traders to profit from price fluctuations.

How do I choose a reliable Volatility 75 Index Forex broker in Vietnam?

Look for brokers with regulatory compliance, a user-friendly platform, competitive spreads, and multilingual support, ensuring a trustworthy trading environment in Vietnam.

Can Vietnamese traders access educational resources for trading the Volatility 75 Index with these brokers?

Yes, many brokers offer educational materials, including tutorials and market analysis, to support Vietnamese traders in enhancing their knowledge and skills.

What risk management strategies are recommended for trading the Volatility 75 Index in Vietnam?

Employ strategies such as position sizing, setting stop-loss orders, and diversification to effectively manage risks when trading the Volatility 75 Index in Vietnam’s dynamic market.

Are there specific considerations or regulations for trading the Volatility 75 Index with Forex brokers in Vietnam?

Traders should be aware of any local regulations and ensure that the chosen broker complies with them. It’s essential to stay informed about any specific considerations when trading the Volatility 75 Index in Vietnam.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is a volatile environment that may change at any time, even if the information supplied is correct at the time of going live.

Best Forex Brokers in Vietnam

Best Forex Brokers in Vietnam

Scam Forex Brokers in Vietnam

Scam Forex Brokers in Vietnam