- Fully Regulated

- Expertly Reviewed

- Secure & Trusted

- Transparent Fees

- Mobile Friendly

Find The Best Vietnam Forex Broker For Your Trading Level.

Forex Trading Brokers in Vietnam

We explore everything from A -Z how to become a skillful trader and who are the best forex brokers in Vietnam for your style of trading.

For Vietnamese Investors, forex trading can be a way to diversify.

Best Forex Brokers in Vietnam

Forex Trading Basics

Forex Terminology

Currency Pairs

How to Start Trading in Vietnam

Forex Trading Platforms

Forex Charting

Forex Trading Risk Management

Pros and Cons of Forex Trading

Best Forex Brokers in Vietnam

Forex Trading Basics

Forex Terminology

Currency Pairs

How to Start Trading in Vietnam

Forex Trading Platforms

Forex Charting

Forex Trading Risk Management

Pros and Cons of Forex Trading

Top 10 Forex Brokers in Vietnam

| 💵 Forex Broker | 👉 Open An Account | 💰 Min Deposit | 📊 Max Leverage | ⚖️ Regulation | ✔️ Accepts Vietnamese Traders |

| HFM | 👉 Open Account | $0 / 0 VND | 1:2000 | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA | Yes |

| AvaTrade | 👉 Open Account | $100 / 2456996 VND | 1:30 (Retail), 1:400 (Pro) | CBI, BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | Yes |

| Markets.com | 👉 Open Account | $100 / 2456996 VND | 1:300 | ASIC, CySEC, FSCA, FCA, BVI FSC | Yes |

| OctaFX | 👉 Open Account | $25 / 614249 VND | 1:500 | CySEC, SVG FSA | Yes |

| Pepperstone | 👉 Open Account | $0 / 0 VND | 1:200 (Retail), 1:500 (Pro) | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB | Yes |

| Exness | 👉 Open Account | $10 / 245699 VND | Unlimited | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA | Yes |

| easyMarkets | 👉 Open Account | $25 / 614249 VND | 1:400 | BVI FSC, CySEC, ASIC, FSA | Yes |

| eToro | 👉 Open Account | $50 / 1228498 VND | 1:30 (Retail), 1:400 (Pro) | CySEC, FCA, ASIC, FSA, NFA, FinCEN, FINRA, SIPC | Yes |

| FBS | 👉 Open Account | $5 / 122849 VND | 1:3000 | IFSC, CySEC, ASIC, FSCA | Yes |

| FP Markets | 👉 Open Account | $100 / 2456996 VND | 1:500 | ASIC, CySEC | Yes |

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

In this comprehensive guide, you’ll learn all you need to know about being a great trader and which forex brokers in Vietnam are best suited for your trading style. Vietnamese traders can easily start earning profits from the competitive, exciting environment forex trading offers.

- Vietnamese legislation does not directly control forex trading activity. The State Bank of Vietnam, Vietnam’s competent authority, does not directly supervise Forex business.

- Vietnam’s Forex market has seen a surge in popularity, with dozens of global Forex brokers establishing their presence.

- Due to the lack of restrictions, forex trading in Vietnam might be difficult. However, even if they must follow stringent laws, it is critical to select a licensed broker.

- While the Vietnamese Dong (VND) can be traded within the country, many traders convert it into major currencies like USD or AUD for broader opportunities in international markets.

- In Vietnam, no specific regulations govern business activity conducted through Forex trading platforms. Although some local organizations may engage in Forex trading, the regulatory framework remains ambiguous.

- The Forex trading landscape in Vietnam blends traditional practices and modern strategies, making it a unique market to explore.

- While Vietnam has put in place exchange control procedures to curb foreign currency outflows, the Law on Investment does allow for certain foreign investments, which may indirectly impact Forex trading.

How profitable is Forex trading for individuals and retail traders? How much do you need to start trading Forex in Vietnam? Can you keep your full-time job while you trade Forex part-time? What are the significant risks involved with trading Forex in Vietnam?

These are just a few questions that many Vietnamese traders may have as beginner forex traders. Explore our website to find the answers to these questions, and more.

Foreign Exchange Trading is a legal activity in Vietnam governed by the State Bank of Vietnam (SBV). However, the bank does not directly oversee forex business or activities.

Furthermore, the State Bank of Vietnam does not officially regulate forex brokers who carry out financial activities. Therefore, regulators such as the FSCA, FCA, CySEC, and others protect Vietnamese traders.

We reveal the best brokers with verified regulations who offer their services locally in Vietnam. Vietnamese Traders can rest assured that these are trusted and legitimate brokers that garner a high trust score or rating.

Forex Trading Pros and Cons

| ✔️ Pros | ❌ Cons |

| Vietnam’s forex market is rapidly changing, providing new chances | Forex trading can be volatile, resulting in substantial losses. |

| Forex trading is available 24 hours a day, giving you flexibility in trading times | Vietnam lacks explicit forex trading regulations. |

| Because of its huge scale, the forex market has significant liquidity, making it simple to initiate and exit trades | In Vietnam, there may be less regulated and reliable brokers. |

| When compared to global norms, fewer traders can mean more opportunities in Vietnam | Trading successfully necessitates a thorough understanding of the market. |

| Trading in Vietnam can provide unique market insights into the economic dynamics of the ASEAN area | Most transactions may necessitate the conversion of VND to major currencies. |

Step-by-Step on How to Start Trading Forex in Vietnam

- Step 1 – Educate Yourself

- Step 2 – Choose a Reliable Broker

- Step 3 – Open a Trading Account

- Step 4 – Use a Demo Account to Practice

- Step 5 – Fund Your Trading Account

- Step 6 – Start Trading

- Step 7 – Monitor and Review Trading Activity

- Step 8 – Withdraw Profits

- Step 9 – Stay Connected with the Forex Community

Step 1 – Educate Yourself

Understanding the complexities of Forex trading is the foundation of a prosperous trading career.

For Vietnamese traders, this entails understanding not only the worldwide fundamentals of currency trading but also the complexities of the Vietnamese economy, its monetary policies, and how global events may affect the Vietnamese Dong (VND).

Vietnam’s financial markets, especially Forex, are becoming more influenced by global economic trends as they integrate more into the global economy. As a result, a broad education will prepare traders to navigate local and worldwide economic waters.

Step 2 – Choose a Reliable Broker

Choosing the correct broker is an important step for every Forex trader, especially in Vietnam, where the Forex market is still in its early stages, and regulations might be vague.

Choosing a user-friendly broker with solid tools and is also regulated by respectable international agencies is critical. This assures that the broker adheres to international transparency and security standards, giving Vietnamese traders piece of mind.

Step 3 – Open a Trading Account

After selecting a broker, the following step is to open a trading account. This step entails supplying personal information and validating one’s identification to protect the security of transactions.

Vietnamese traders must understand the broker’s verification process, which may need certain documentation attesting to the trader’s identity and domicile. While administrative, this step is critical for assuring the safety and protection of your money.

Step 4 – Use a Demo Account to Practice

To enhance confidence among individuals in Vietnam, where Forex trading is still gaining momentum, Vietnamese traders must practice with a demo account before engaging in actual trading.

This virtual platform effectively replicates real market conditions but utilizes fictional money, enabling traders to familiarize themselves with the market without risking their funds.

It allows them to grasp the dynamics of the Forex market and experiment with various trading techniques while acquainting themselves with the associated trading platform.

Step 5 – Fund Your Trading Account

Vietnamese traders can progress to live trading by financing their accounts after developing confidence with a demo account. Depending on the broker, several funding options may be available, ranging from bank transfers to e-wallet solutions.

Therefore, it is important to understand transaction fees, currency conversion rates (particularly when converting from VND to USD or other major currencies), and the security measures for financial transactions.

Step 6 – Start Trading

The thrilling world of live Forex trading begins with a funded account. This entails actively buying and selling currency pairings, monitoring market patterns, and making informed judgments based on global and local economic news.

Vietnamese traders must remember the value of risk management. Setting stop-loss orders and investing just what you can lose can protect you against volatile market swings.

Step 7 – Monitor and Review Trading Activity

Currency prices fluctuate in the Forex market due to a variety of variables. For Vietnamese traders, this entails constantly reviewing their deals, getting up to current on both global and local news, and modifying their methods as needed.

Reviewing previous trades regularly aids in determining which trading strategies work and where improvements can be made. The potential and challenges in Vietnam’s Forex market will shift as the country’s economy expands and evolves.

Step 8 – Withdraw Profits

The purpose of Forex trading is to make money. When Vietnamese traders realize profits, they may contemplate withdrawing their funds.

Therefore, traders must understand the withdrawal process of the broker, including any associated fees. Furthermore, understanding currency conversion rates, particularly when converting gains from major currencies back to VND, is critical to ensuring optimal returns.

Step 9 – Stay Connected with the Forex Community

Forex trading goes beyond individual trades; it encompasses becoming a member of a global community. This involves establishing connections with fellow traders within the local and international context, specifically for Vietnamese traders.

Exchanging knowledge, devising strategies, and drawing wisdom from others’ experiences can provide valuable insights. As the Vietnamese Forex trading community expands, opportunities to network and gain knowledge similarly enhance prospects for growth and development.

4 Best Currency Pairs for Beginner Vietnamese Traders to Trade

USD/JPY (US Dollar/Japanese Yen)

The USD/JPY currency pair denotes the exchange rate between the US Dollar and the Japanese Yen. Its value depends on factors including US economic indicators, policies of Japan’s central bank (the Bank of Japan), geopolitical events, and market sentiment.

Essentially, it indicates how strong or weak the US Dollar stands against the Japanese Yen. This particular currency pair holds appeal among traders owing to its high liquidity and responsiveness towards international economic shifts.

Why USD/JPY is Suitable for Beginners

The USD/JPY exchange rate is relatively stable. The pair also responds favorably to technical analysis, and numerous resources are available to help traders comprehend its price movements.

EUR/USD (Euro/US Dollar)

The exchange rate between the Euro and the Dollar, known as the EUR/USD pair, is depicted through various factors.

These include economic data from the Eurozone and the US, releases of monetary policies by the European Central Bank and Federal Reserve, and prevailing global market trends.

Why EUR/USD Suitable for Beginners

The liquidity of the EUR/USD pair is high, signifying a large number of trading activities and ample information available. The movements are typically smooth, and beginners find it easier to conduct research and analysis due to the wealth of online resources.

AUD/USD (Australian Dollar/US Dollar)

The AUD/USD currency pair symbolizes the Australian and US Dollar exchange ratio.

It portrays how well or poorly the Australian Dollar performs relative to its American counterpart, influenced by various factors such as Australia’s economic indicators, commodity prices, decisions made by the Reserve Bank of Australia, and global economic sentiment.

This makes it an appealing option for traders desiring investment opportunities tied to the prosperity of the Australian economy.

Why AUD/USD is Suitable for Beginners

Traders are provided with a unique indicator by the sensitivity of AUD/USD due to the Australian economy’s heavy reliance on commodities and its resulting correlation with commodity prices.

However, while being a liquid pair, it tends to have less extreme volatility than more obscure market pairs.

GBP/USD (British Pound/US Dollar)

The GBP/USD pair represents the exchange rate between the British Pound and the United States Dollar.

It emphasizes the strength of the Pound against the Dollar. It is influenced by UK economic data, Bank of England policies, US economic indicators, geopolitical developments, and investor sentiment, making it a significant option for traders following the UK and US markets.

Why GBP/USD is Suitable for Beginners

GBP/USD has an extensive history of trends and ranges that novice traders can study. Additionally, it is less volatile than some more exotic currency pairs, making it simpler to monitor and predict.

4 Best Currency Pairs for Professional Vietnamese Traders to Trade

EUR/JPY (Euro/Japanese Yen)

The EUR/JPY currency pair signifies the rate at which the Euro can be exchanged for the Japanese Yen, reflecting the Euro’s strength compared to the Yen.

This pairing is influenced by factors such as economic indicators within the Eurozone, policies set forth by Japan’s Bank of Japan, and overall market sentiment. As a result of these influences, it appeals to speculators who wish to gain exposure in both European and Japanese markets.

Why EUR/JPY is Suitable for Professionals

This currency pair comprises two primary currencies, excluding the US dollar. It necessitates understanding and expertise in both European and Asian markets, thereby catering more towards experienced traders.

USD/CNH (US Dollar/Chinese Offshore Yuan)

This currency pair represents the exchange rate between the US Dollar and the Chinese Offshore Yuan. It signifies how much value the USD holds compared to offshore Yuan traded beyond China’s mainland borders.

Furthermore, this duo is impacted by various factors, including economic relations between the US and China, global trade conditions, and alterations in Chinese monetary policies.

Why USD/CNH is Suitable for Professionals

Given the economic interaction between China and Vietnam, professional Vietnamese traders may have insight into the movement of the CNH. This volatile currency pair can necessitate a comprehensive comprehension of the Asian market.

USD/ZAR (US Dollar/South African Rand)

The USD/ZAR currency pair represents the US Dollar and South African Rand exchange rate. It represents the value of the US dollar relative to the South African rand and reflects the economic conditions of the two countries.

This currency combination is influenced by US economic indicators, South African economic trends, commodity prices, and global risk sentiment, attracting traders interested in emerging market dynamics.

Why USD/ZAR is Suitable for Professionals

Exotic currency pairs, such as USD/ZAR, can be unpredictable and have less liquidity than major currency pairs. However, those who comprehend the specific economic and political factors that influence the South African Rand can realize substantial profit margins.

GBP/JPY (British Pound/Japanese Yen)

British Pound/Japanese Yen (GBP/JPY): The GBP/JPY unit represents the exchange rate between the British Pound and the Japanese Yen.

It reflects the performance of the Pound relative to the Yen. It is influenced by UK economic data, Bank of England actions, Japan’s monetary policy, and geopolitical events, making it a popular choice for traders seeking to capitalize on cross-market opportunities.

Why GBP/JPY is Suitable for Professionals

Its volatility can present substantial profit opportunities but also entail elevated risk. Traders with a solid risk management strategy can navigate the market’s volatility.

9 Best Forex No-Deposit Brokers in Vietnam

| 🏅 No-Deposit Broker | 👉 Open Account | 🎁 Additional Bonusses / Promotions | 💰 Minimum Deposit | 🎉 Trading Platform |

| SuperForex | 👉 Open Account | 50% Welcome Bonus 300% Hot Bonus 75% Energy+ Bonus 3000% Easy Deposit Bonus | $1/ 4505 VND | MetaTrader 4 SuperForex App |

| Admiral | 👉 Open Account | 100% bonus program 100% Welcome bonus | $100 / 2450499 VND | MetaTrader 4 MetaTrader 5 Admirals Mobile App |

| FreshForex | 👉 Open Account | +10% Crypto Deposit 300% Deposit Bonus 101% Drawdown Bonus | $100 / 2450499 VND | MetaTrader 4 MetaTrader 5 |

| InstaForex | 👉 Open Account | 100% Deposit Bonus 55% Deposit Bonus 30% Bonus Bonus Instaforex Club Bonus | $1/ 4505 VND | MetaTrader 4 MetaTrader 5 WebIFX InstaForex Multi-Terminal InstaForex WebTrader InstaTick Trader InstaForex MobileTrader |

| ForexChief | 👉 Open Account | +10% Crypto Deposit 300% Deposit Bonus 101% Drawdown Bonus | $100 / 2450499 VND | MetaTrader 4 MetaTrader 5 |

| XM | 👉 Open Account | 50% Deposit Bonus 20% Deposit Bonus | $5 / 122525 VND | MetaTrader 4 MetaTrader 5 XM Mobile App |

| JustMarkets | 👉 Open Account | 120% Deposit Bonus | USD 10 / 245699 VND | MetaTrader 4 MetaTrader 5 JustMarkets App |

| Tickmill | 👉 Open Account | Trader of the Month Intoducing Broker Contest | $100 / 2450499 VND | MetaTrader 4 MetaTrader 5 |

| Windsor Brokers | 👉 Open Account | Trading Challenge Deposit Bonus Loyalty Programme | $50 / 1225249 VND | MetaTrader 4 Windsor Brokers App |

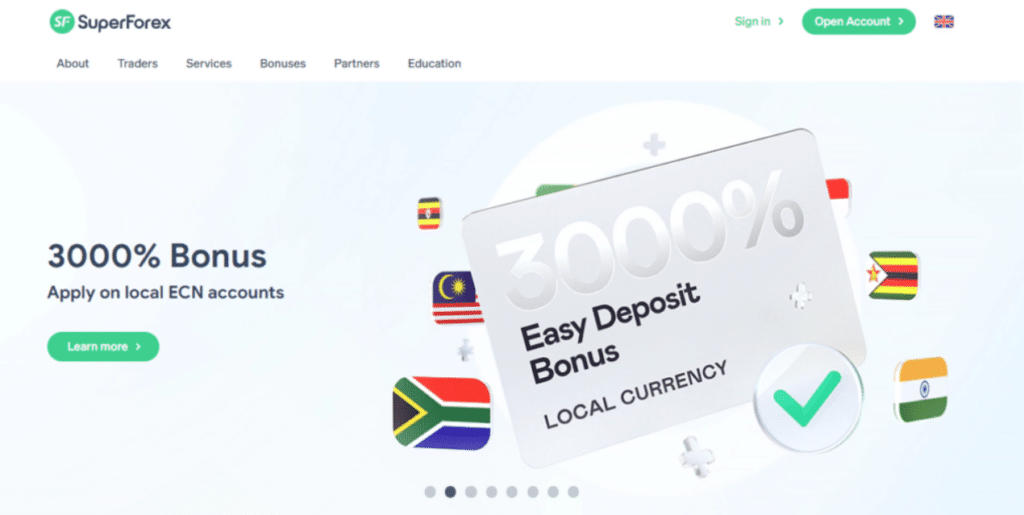

1. SuperForex

Min Deposit

$1/ 4505 VND

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

Islamic Account

300

Yes

Trading Fees

Low

Account Activation

24 Hours

SuperForex provides new Forex traders with a $88 no-deposit bonus to get them started on their trading voyage. This incentive is intended to give traders a taste of real trading without requiring an initial financial investment.

Customers with a fully verified live trading account are eligible for the bonus. Register a live Standard trading account, complete the verification procedure, and then request the No Deposit Bonus.

One of the most notable features of this incentive is the ability to withdraw trading profits. The withdrawal quantity is based on the trading volume using the formula: 1 lot = $1. To withdraw $50, for example, a trader must have traded at least 50 units.

Overview

| Feature | Information |

| ⚖️ Regulation | IFSC |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | $1/ 4505 VND |

| 📈 Average spread from | Variable spread |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| SuperForex offers user-friendly trading software | US clients are restricted from registering with SuperForex |

| There is a low minimum deposit requirement | |

| Traders have access to wide range of training resources | |

| SuperForex offers a range of useful trading tools | |

| There are social trading opportunities provided |

2. Admiral Markets

Min Deposit

USD 25 / 612624 VND

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

MT4, MT5, Admirals Mobile App

Crypto

Yes

Total Pairs

35+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Admirals offers a unique opportunity to Vietnamese traders through its exclusive “Exclusive Bonus” program. With a dedicated allotment of 100 USD, this incentive has been thoughtfully created to assist beneficiaries within the Vietnamese trading community with better trading capabilities.

The “Exclusive Bonus” is valid and operational for 30 days after purchase, thereby assisting traders by increasing the available margin for their trades. This increased margin allows for larger trading positions and potentially increases total trading potential.

It should be noted that while the “Exclusive Bonus” provides traders with increased margin capacity, it is not meant to correct trade imbalances. Traders must thoroughly understand their trading techniques and follow cautious risk management practices.

Overview

| Feature | Information |

| ⚖️ Regulation | MiFID |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | 612624 Vietnamese Dong equivalent to $25 |

| 📈 Average spread from | From 0.5 pips |

| 📈 Maximum Leverage | 1:30 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Multiple account choices | There is an inactivity fee charged |

| Admirals offer commission-free options | There are deposit and withdrawal fees charged |

| There are user-friendly platforms available across devices | Admin fees charged on the Islamic account |

| There is a wide range of tradable markets, complex instruments, and leveraged products | There is only one account type that can be converted to an Islamic Account |

3. freshforex

Min Deposit

USD 0 / 0 VND

Regulators

CRFIN

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

50+

Islamic Account

No

Trading Fees

Low

Account Activation

24 Hours

FreshForex offers a generous $99 no-deposit incentive to new customers, allowing them to enter the world of Forex trading with no initial investment. This promotion is available to new clients who register via a special link during the promotion period. After registration, bonus funds are displayed in the “Credit” field and cannot be withdrawn. However, profits from trading with the incentive can be withdrawn after meeting certain requirements. The incentive is valid for seven calendar days, but customers can extend it by making any deposit.

Profits and deposits stored in the “Balance” field are entirely withdrawable but can only be lost due to losses after the bonus has been exhausted.

For the initial withdrawal, customers must authenticate their personal information and deposit to verify their payment information.

Overview

| Feature | Information |

| ⚖️ Regulation | SVG FSA |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | 0 Vietnamese Dong $0 |

| 📈 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:2000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker offers both variable and fixed spreads | Unregulated and offshore broker |

| There is no minimum deposit requirement | There are several regions restricted from accessing SuperForex’s services |

| There are daily analysis tools and trading signals available | Spreads are marked-up |

| VPS access is provided to eligible clients | There is a limited selection of markets offered |

| There are several flexible account types to choose from |

4. Instaforex

Min Deposit

USD 1/ 4505 VND

Regulators

CySEC, FSC

Trading Desk

MetaTrader 4

MetaTrader 5

MultiTerminal

WebTrader

Crypto

Yes

Total Pairs

100+

Islamic Account

No

Trading Fees

Low

Account Activation

24 Hours

InstaForex provides Forex traders with an attractive no-deposit incentive, allowing them to begin trading with an impressive $1,000 credited to their live trading account.

This incentive allows traders to experience real trading conditions without incurring any financial risk or making any personal investments. The bonus is promptly credited upon request and is immediately tradeable.

Traders can use this incentive to trade commodities, energy, indices, equities, currencies, metals, and cryptocurrencies. While bonus funds cannot be withdrawn directly, profits from trading bonus funds can be withdrawn if all bonus agreement terms are satisfied.

Overview

| Feature | Information |

| ⚖️ Regulation | BVI FSC, CySEC, FSA SVG, FCA |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | 4505 Vietnamese Dong $1 |

| 📈 Average spread from | 0.0 pips EUR/USD |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker offers commission-free trading | There are restrictions on leverage for European Union clients |

| MetaTrader 4 and 5 are both offered, available across devices | US clients are not accepted |

| The broker is well-regulated and offers competitive trading conditions | |

| There is a choice between retail investor accounts, each suited to different types of traders | |

| There is a wide range of tradable assets offered |

5. ForexChief

Min Deposit

USD 100 / 2450499 VND

Regulators

VFSA

Trading Desk

MetaTrader 4, MetaTrader 5, Mobile Trading

Crypto

Yes

Total Pairs

40

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

ForexChief offers new traders a lucrative $100 no-deposit bonus, ensuring a risk-free beginning to their Forex trading voyage. This incentive is a fantastic way for traders to evaluate the company’s services and test their preferred trading strategies.

After successful account verification, the bonus is credited to the ForexChief mobile application. There is no need for personal funds, the verification process is quick, and the benefit duration is unlimited.

Once the requisite trading volume has been met, traders can withdraw the $100 bonus. Profit can be withdrawn once the trading volume reaches USD 10,000,000. The bonus amount cannot be withdrawn, but profits can be.

It is important to note that the bonus is unavailable in certain countries and that any violation of its terms can result in its cancellation.

Overview

| Feature | Information |

| ⚖️ Regulation | VFSA |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | 0 Vietnamese Dong $0 |

| 📈 Average spread from | from 0.9 pips EUR/USD |

| 📈 Maximum Leverage | 1:500 |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Traders need not deposit funds into an account to start trading. | No trading credits (analog of bonus for depositing) on МТ5 |

| The 100 USD is automatically credited to the ForexChief app once account verification is completed. | No swap-free trading for cent accounts |

| ForexChief does not restrict traders in terms of trading strategies or trading robots. | No welcome bonuses on opening cent accounts |

| Once traders have achieved the required trading volume, they can withdraw their 100 USD. | |

| The no-deposit bonus does not expire. |

6. XM

Min Deposit

USD 5 / 122225 VND

Regulators

IFSC, CySec, ASIC, FCA

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Crypto

Yes

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation

24 Hours

XM is a well-known Forex broker that provides new clients with a $30 no-deposit incentive, allowing them to begin trading without making an initial investment. This bonus is promptly credited upon successful account verification and is immediately available for trading.

The $30 bonus will enable traders to test XM’s trading platform and services in a real-world trading environment. While the bonus cannot be withdrawn, any profits generated from trading with the bonus can be withdrawn after meeting volume requirements.

XM Overview

| Feature | Information |

| ⚖️ Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

| ⚖️ SBV Regulation | No |

| ✔️Trading Accounts | Standard Account Live Account, Base Account, Demo Account, Islamic Account |

| 💳 Minimum deposit (VND) | USD 5 / 122225 VND |

| 📈 Trading Platforms | MetaTrader 4 MetaTrader 5 |

| 📈 Trading Assets | Forex Precious Metals Stock CFDs Indices Individual Shares Cryptocurrency Energies Commodities |

| 👥 Social Media Platforms | Facebook YouTube |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| XM is a reputable online brokerage firm that boasts a substantial membership base of over 5 million individuals. The company has garnered a well-established reputation for conducting its operations inside a resilient regulatory framework. | Clients situated in the United States, Canada, Israel, and Iran are not accepted by XM |

| Investors might find solace in the fact that the platform prioritises safety and implements measures to protect customer assets. | XM does not provide accounts with fixed spreads. |

| Negative balance protection provides a safeguard for investors in retail accounts by mitigating the potential financial losses resulting from market swings. | Retail investor accounts may incur a fee for inactivity. |

| Vietnamese traders have the ability to choose from a variety of account settings and trading interfaces that have been specifically created to cater to the distinct needs of the consumers. | |

| Since its establishment in 2009, XM has garnered several significant accolades, hence substantiating its value within the industry as a whole. | |

| In order to enhance the customer experience, XM has implemented a policy of not imposing any charges for depositing or withdrawing funds. |

7. JustMarkets

Min Deposit

USD 10 / 245699 VND

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

240

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Through its distinctive “Welcome Account” feature, JustMarkets offers a $30 Welcome Bonus. This one-of-a-kind account enables new traders to trade FX currency pairs and commodities denominated in USD.

However, it is vital to remember that each trader is limited to a single no-deposit bonus to ensure system fairness and a secure trading environment.

Overview

| Feature | Information |

| ⚖️ Regulation | Seychelles Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySec) |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | USD 10 / 245699 VND |

| 📈 Average spread from | N/A |

| 📈Trading Platform | MetaTrader 4 MetaTrader 5 JustMarkets App |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| JustMarkets offers a huge range of deposit methods and withdrawal options including bank wire transfers, bank transfers, Skrill, Neteller, and more | There is a limited choice of trading instruments |

| Demo trading and Islamic Swap-Free Accounts are offered | Inactivity Fees may apply after following several days of dormancy |

| JustMarkets offers mobile trading through powerful mobile trading apps | The broker does not have regulation through a reputable and trusted regulatory body |

| JustMarkets offers competitive cryptocurrency spreads across crypto pairs including Bitcoin, Ethereum, and others | |

| JustMarkets’s non-trading fees are reasonable |

8. Tickmill

Min Deposit

USD 100 / 2444503 VND

Regulators

CySEC, FCA, FSA, FSCA, Labuan FSA

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

62

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Tickmill’s $30 Welcome Account is an excellent opportunity for new traders, allowing them to enter the world of Forex trading risk-free. This account is intended to give new clients actual trading experience without requiring an initial deposit.

The Welcome Account is straightforward and includes a complimentary $30 deposit. Notably, proceeds can be withdrawn from this account. Traders must register a client Area account, submit identification documents, and deposit a minimum of $100 to their Wallet to trade.

Furthermore, the transfer of profits from the Welcome Account to the Client’s Wallet is contingent upon certain conditions, such as minimum trading volume requirements.

Notably, the initial $30 deposit is non-refundable, but profits can be withdrawn, making this a lucrative offer for those seeking to test the waters of Forex trading.

Overview

| Feature | Information |

| ⚖️ Regulation | FSA, FCA, CySEC, Labuan FSA, FSCA |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | $100 / 2450499 VND |

| 📈 Average spread from | From 0.0 pips |

| 📈Trading Platform | MetaTrader 4, MetaTrader 5 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Tickmill is well-known for its low trading costs and high level of user trust. | No fixed spread accounts available |

| Convenient payment methods such as Skrill, Neteller, and others are available. | |

| There are several resources available to sophisticated traders, including the FIX API, AutoChartist, virtual private servers, and more. |

9. Windsor Brokers

Min Deposit

$50 / 1225249 VND

Regulators

CYSEC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

50

Islamic Account

No

Trading Fees

Low

Account Activation

24 Hours

Windsor Brokers offers a $30 Free Account promotion for new clients to experience Forex and CFD trading with no initial investment. To take advantage of this offer, traders must take three basic steps:

Apply for the Free Account Worth $30.

Complete the registration procedure and verify that all account opening requirements are met.

Once approved, a complimentary trading credit of $30 will be added to the account.

This promotion excludes new clients with Prime Accounts with a USD, EUR, GBP, or JPY currency base. It is essential to note that the bonus amount is intended for trading, and while the initial bonus cannot be withdrawn, trading profits can.

Overview

| Feature | Information |

| ⚖️ Regulation | FSC, CYSEC, JSC, FSA,CMA |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | $50 / 1225249 VND |

| 📈 Average spread from | from 1.0 pips |

| 📈Trading Platform | MetaTrader 4 Windsor Brokers App |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Windsor Brokers is multi-regulated in several regions | There is only one account that can be converted into an Islamic Account |

| The broker offers several markets that can be traded via MetaTrader 4 | Withdrawal fees apply to several payment methods |

| Multilingual customer support is available |

5 Most Successful Forex Traders in Vietnam

Le Thí Bao

Background

Le Thí Bao’s journey into the world of Forex demonstrates her tenacity and determination. She was raised in an underprivileged home in Ho Chi Minh City and had various obstacles as a child.

However, meeting with a Forex trader during college sparked her interest in currency trading. She immersed herself in education, frequently staying up late analysing charts and market movements.

Achievements

Today, she serves as a role model for many ambitious female traders in Vietnam, demonstrating that hard work makes success attainable.

Dao Thi Kim Ngan

Background

Dao Thi Kim Ngan’s debut in the Forex market was unusual. She was born in the peaceful city of Can Tho and managed a thriving local company.

She was introduced to Forex through a business transaction, and seeing the potential, she wanted to diversify her investments. Her aggressive business skills translated well into Forex trading, and she quickly became a powerful trader.

Achievements

Dao’s early success in Forex led her to start one of Vietnam’s finest Forex training colleges, where she mentors the next generation of traders.

Tran Minh Tuan

Background

Tran Minh Tuan first became acquainted with international markets when he was awarded a scholarship to study finance in Europe. While abroad, he met with global traders and learned about advanced trading tactics.

When he returned to Vietnam, he coupled his foreign experience with local market understanding, putting him on the fast track to Forex success.

Achievements

Tran’s trading style is a blend of Western tactics and Eastern market sensibilities, and he is known for his rigorous risk management strategies.

Pham Quoc Dat

Background

Pham Quoc Dat, originally from the seaside city of Da Nang, began his career in the stock market. His analytical skills rapidly propelled him to success as a stock trader.

The attraction of the 24-hour Forex market, on the other hand, lured him in. His shift was aided by his extensive knowledge of financial markets and ability to adapt his stock trading tactics to the Forex market.

Achievements

Pham’s creative trading algorithms, adapted for the Vietnamese market, earned his colleagues’ respect and admiration.

Nguyen Van Tai

Background

Nguyen Van Tai, born and brought up amidst the lively avenues of Hanoi, hails from a family deeply rooted in conventional stock trading.

Immersed in the realm of money and investments since his early years, he stumbled upon the intriguing domain of Forex while pursuing finance studies at Vietnam National University.

Nguyen’s initial encounter with trading and his academic expertise bestowed him with an extraordinary standpoint that enabled him to detect elusive patterns and trends evading others’ notice.

Achievements

Nguyen has consistently produced remarkable returns over the last decade, making him a recognized figure in Vietnam’s Forex community.

Secrets to the success of these Professional Traders

- Continuous Learning: The Forex market is always changing. These traders devote time and resources to ongoing education, such as attending seminars and conferences and staying current on global Forex trends.

- Emotional Discipline: Trading may be a rollercoaster ride. Conversely, these traders have perfected the art of emotional discipline, making decisions based on logic and analysis rather than feelings.

- Innovative Strategies: Instead of depending entirely on traditional methods, these traders are noted for their unique trading strategies, which frequently combine technical and fundamental analysis to predict market changes.

- Risk Management: One thing that these successful traders have in common is that they have excellent risk management tactics. They never put more than a percentage of their trading capital at risk, guaranteeing that they can weather any market downturns.

- Networking: Being a part of a community is beneficial. These traders frequently converse, share thoughts, and learn from one another’s experiences. This networking provides them with a broader view of market trends.

- Deep Market Understanding: These traders spend hours analyzing global and local economic news to determine how different factors influence currency movements. Their extensive market knowledge enables them to make sound decisions.

How to Choose a Forex Broker in Vietnam

The selection of a suitable Forex broker is of the utmost importance for Vietnamese traders beginning their trading voyage. Given the burgeoning nature of Forex trading in Vietnam, it is prudent to consider this crucial choice carefully. For assistance with this procedure, the following procedures are suggested:

- Trading Platform Suitability: The selected broker’s trading platform should have an intuitive interface, unwavering stability, and various trading tools.

- Currency Pair Diversity: Choose a broker that offers a vast selection of currency pairs, especially those that accord with your trading preferences.

- Educational Resources and Tools: Consider brokers that provide educational resources, such as webinars, eBooks, articles, and indispensable trading tools, such as economic calendars and analytical aides.

- Demo Account Availability: Brokers who offer demo accounts provide a valuable opportunity for practice without the risk of losing real money.

- Regulatory Compliance: Prioritize brokers regulated by established financial authorities regarding regulatory compliance, especially because there is no official regulator in Vietnam.

- Deposits and Withdrawals: Assess the viability of deposit and withdrawal methods. Choose brokers that offer convenient and economical payment methods, such as bank transfers, credit cards, and online payment systems.

- Reputation Examination: Before making a final decision, conduct exhaustive research by evaluating testimonials and feedback from other Vietnamese traders.

- Transparent Pricing Structure: Evaluate brokers according to their commission rates and spreads. Seek out brokers who provide competitive spreads and transparent commission structures that correspond to your trading strategy.

- Robust Customer Support: Given the importance of excellent customer service, you should prioritize brokers with responsive support teams. Favor those who can communicate in Vietnamese and are available 24 hours a day, seven days a week, as this is essential for novice Forex traders navigating the market.

Before You Start Trading, Read these Few Basics to Forex Trading

The Forex (foreign exchange) market is the largest financial market in the world, where currencies are traded against one another. This involves understanding not only major worldwide currencies but also the dynamics of the Vietnamese Dong (VND) in this dynamic market.

Leverage and Margin

Leverage enables traders to handle a greater position with less capital. For example, with leverage of 1:100, a trader can handle a $100,000 position with only $1,000 in their account.

However, leverage magnifies dangers. Vietnamese traders must understand the ramifications of leverage and apply it prudently.

Furthermore, the amount of capital necessary to initiate a leveraged position is called the margin. It is a security deposit required by brokers to cover any transaction losses.

Forex Brokers and Platforms

Vietnamese traders who want to trade Forex must first open an account with a Forex broker. Choose a broker regulated by renowned international agencies to ensure transparency and security.

Furthermore, many brokers provide platforms such as MetaTrader 4 or 5, which provide tools for trade analysis and execution.

Currency Pairs

Currency pairs are traded in Forex, with one currency exchanging for another. The first currency in the pair is known as the ‘base’ currency, while the second is known as the ‘quote’ currency. For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency.

Overall, the pair’s pricing reflects how much of the quotation currency is required to buy one unit of the base currency.

Continuous Learning and Practice

The Forex market is highly volatile, with prices impacted by various factors. Vietnamese traders should continue to educate themselves, stay current on global and local news, and implement their methods.

Many brokers provide demo accounts, allowing traders to practice without risking real money.

Cultural and Economic Understanding

Understanding the cultural and economic intricacies of Vietnam is useful for Vietnamese traders. Recognizing national holidays, comprehending the central bank’s monetary policies, and staying on top of major economic news can give you an advantage in trading.

Analysis: Fundamental and Technical

- Fundamental Analysis: Vietnamese traders must comprehend global events and local Vietnamese economic indicators as they engage in fundamental analysis. This analytical approach involves studying macroeconomic factors like economic indicators and political events to make predictions about currency fluctuations.

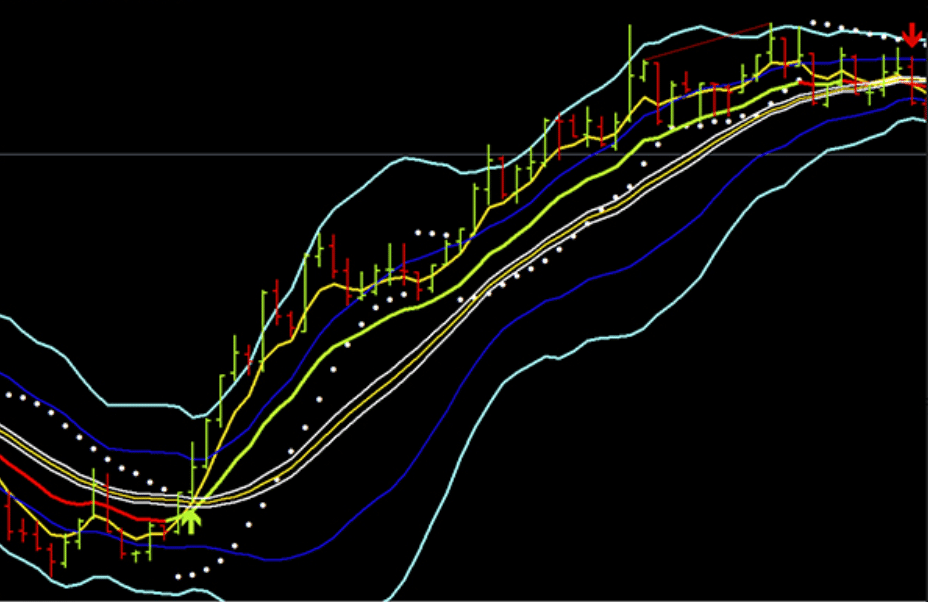

- Technical Analysis entails the examination of price charts and the use of statistical indicators to anticipate future changes in prices. Several useful tools like moving averages, Bollinger bands, and Fibonacci retracement can aid this endeavor.

Risk Management

Forex trading entails substantial risks. Vietnamese traders should always use stop-loss orders to limit potential losses. You should never risk more than a modest percentage of your trading capital on a single trade.

20 Forex Terms You Must Know

- Forex (Foreign Exchange) – The global marketplace for purchasing and selling currencies. It is a decentralized market, which means no central exchange and deals are conducted over the counter (OTC) over electronic networks.

- Currency Pair – A quotation of two separate currencies, with the value of one currency quoted against the value of the other. The first is known as the “base currency,” while the second is known as the “quote currency.”

- Pip (Percentage in Point) – In the Forex market, the smallest price movement. In most currency pairs, a pip is the fourth decimal position. For example, if the EUR/USD crosses from 1.1050 to 1.1051, a 0.0001 increase in value equals one pip.

- Lot – A standardized quantity of the exchanged instrument. A normal lot in Forex is 100,000 units of the base currency. Mini-lots (10,000 units) and micro-lots (1,000 units) are also available.

- Leverage – A tool that enables traders to control a greater position with less capital. It’s expressed as a ratio, such as 1:100, which means a trader can control a position 100 times the size of their deposit.

- Margin – The amount of capital a broker needs to keep an open position in the market. It serves as collateral for a position and assures that the trader has sufficient funds to cover any potential losses.

- Spread – The difference between a currency pair’s purchase (bid) and selling (ask) prices. It is the broker’s profit from the trade (net of commissions or fees).

- Bid and Ask Price – The bid price reflects the capital a broker is willing to allocate to acquire the base currency. In contrast, the offer price represents the rate the broker is willing to sell the currency. Traders navigate this market by purchasing at the offer price and sales at the bid price.

- Stop-Loss Order – A buy or sell order made with a broker after the stock reaches a certain price. It is a tool for preventing significant losses in volatile market conditions.

- Take-Profit Order – An order set to automatically close an open position whenever a particular profit level is reached.

- Bullish and Bearish – Bullish and bearish market trends are defined as positive or upward, whereas bearish market trends are negative or downward.

- Long and Short Positions – Long and short positions are defined as purchasing a currency pair with the assumption that its value will rise. On the other hand, taking a ‘short’ position entails selling a currency pair in anticipation of a decline in its value.

- Liquidity – The ability of an asset to be easily turned into cash without influencing its price is referred to as liquidity.

- Slippage is defined as the difference between a trade’s estimated price and the price at which the trade is performed. It frequently happens during times of extreme volatility.

- Swap or Rollover Rate – The interest paid or gained for maintaining a currency position overnight. It is based on the interest rate disparity between the pair’s two currencies.

- Breakout – When the price moves over a resistance level or below a support level on a higher volume, it indicates the possibility of a new trend.

- Resistance and Support Levels – Resistance is a price level at which a currency pair tends to stop rising and may even fall. A price level at which a currency pair tends to stop dropping and may even gain is referred to be support.

- Fundamental Analysis – A method of determining currency value by examining economic data, government policies, and societal issues.

- Technical Analysis forecasts future price movements using charts and technical indicators based on historical price data and trading volume.

- Volatility is the degree of uncertainty or risk associated with the magnitude of movements in the value of a currency pair. Higher volatility indicates that the currency pair may be stretched over a wider range of values.

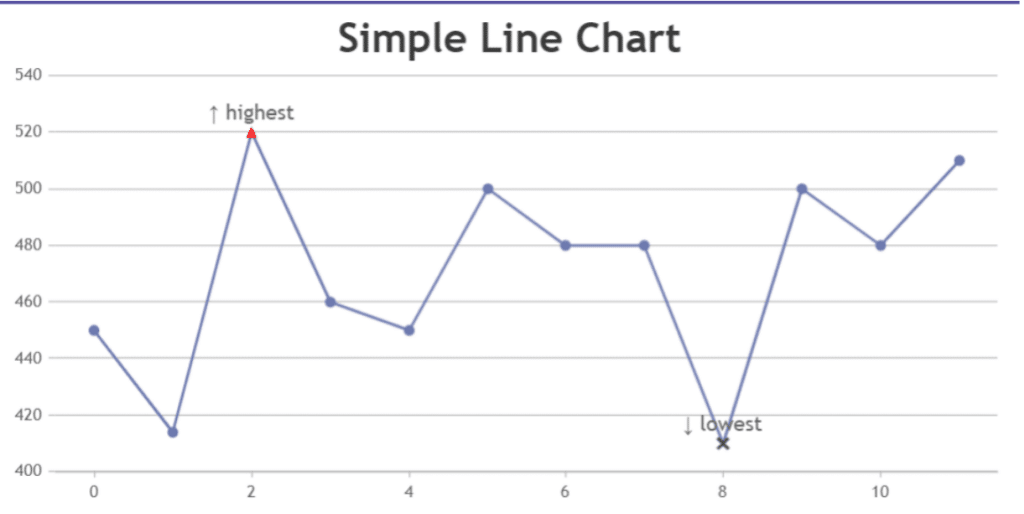

Understanding Forex Charting

Understanding Forex Charting (with examples)

Vietnamese traders can acquire vital insights by utilizing a forex chart to examine historical performance data for currency pairs.

This visual depiction exhibits price and volume information, presenting the movements of a particular currency’s value over time through technical forms, indicators, and overlays.

Line Charts

Line charts provide vital insight by briefly summarizing market movements and existing support and resistance levels. However, line charts lack individual price bar data, so they are insufficient for trading judgments.

Nonetheless, regular observation can provide a larger directional understanding. Such charts connect highs, lows, or opens and closes over time, with closing prices taking precedence. This depicts the struggle between bullish and bearish forces, making it an important choice for study.

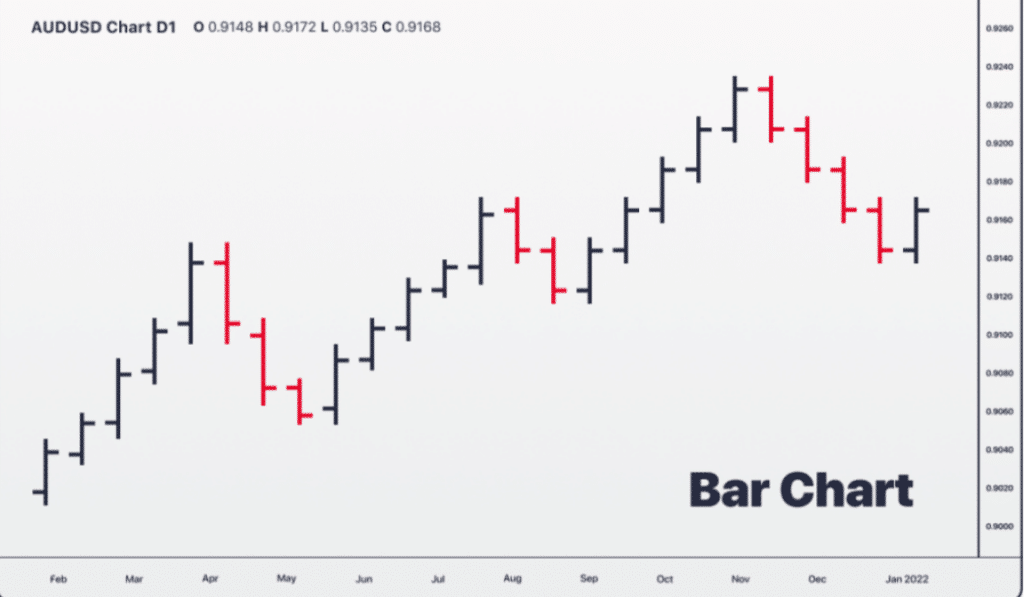

Bar Charts

Each “bar” represents a certain price range over a specified period. Daily charts, for example, have one bar per day. Each bar provides four data points – open, high, low, and close – that can be used to make trading decisions. This data collection is exemplified by “OHLC plots” on bar charts.

Candlestick Charts

While providing the same information as bar charts, candlestick charts have a higher visual appeal. Like bar charts, Candlestick charts use vertical lines to illustrate price movement within specific timeframes.

The top vertical line represents the upper shadow, and the bottom line represents the lower shadow, referred to as wicks. The illustration of opening and closing pricing makes a notable distinction.

The broad candle body, known as the “real body,” represents the spread between opening and closing prices. A filled or darker real body denotes a day’s end at a lower value than its beginning, whereas an unfilled or lighter real body denotes the inverse.

In contrast, a light real body, for example, will place the close at the top and the open at the bottom, whereas dark bodies may reverse this arrangement.

Effective Risk Management for Vietnamese Forex Traders

Understand the Importance of Risk Management

The process of recognizing, analyzing, and reducing prospective losses in trading is known as risk management.

The market’s unpredictable nature, combined with the Vietnamese Dong (VND) fluctuations and global economic considerations, makes risk management critical for Vietnamese Forex traders.

Practice Emotional Discipline

Trading can be an emotional endeavor, especially when losses occur. Traders must remain cool and adhere to their strategy rather than make rash judgments based on emotions.

Educate Yourself, and Keep Learning

Continuous education is essential. Vietnamese traders should put time aside to study new risk management approaches, attend seminars, and participate in webinars. The more knowledgeable a trader is, the better prepared they are to deal with market volatility.

Limit Your Use of Leverage

Leverage enables traders to handle a greater position with less capital. While this can increase profits, it can also increase losses.

Vietnamese traders should utilize leverage sparingly and thoroughly comprehend its effects. It is best, to begin with minimal leverage and gradually raise it as one gets experience and confidence.

Always Use Stop-Loss and Take-Profit Orders

- Stop-Loss Order: This is a price-level-specific automated order. If the market swings against a trader’s position and hits this level, the trade will be closed immediately, minimizing potential losses.

- Take-Profit Order: Like a stop-loss order, a take-profit order automatically terminates a transaction when it hits a predetermined profit threshold.

Diversify Your Currency Pairs

Diversification entails spreading assets across multiple currency pairings to mitigate the impact of any pair’s unfavorable swings. By diversifying, Vietnamese traders might avoid risks linked with specific economic events or geopolitical changes influencing a given currency.

Set Aside a Dedicated Trading Capital

Vietnamese traders should set aside a specified amount of funds for Forex trading only. This should be a sum they are willing to risk without jeopardizing their financial security. Traders can maintain financial stability by not tapping into cash intended for other objectives.

Regularly Review and Improve Strategies

There is no failsafe approach. Analyzing trading performance regularly and altering strategies based on the results is critical. Due to shifting market conditions, what worked in the past may no longer be effective.

Always have Realistic Profit and Loss Expectations

Every trade has the potential for profit and loss. Vietnamese traders should have realistic expectations based on extensive market research. Traders can make more educated judgments by determining prospective profit targets and acceptable loss thresholds.

Continuous Market Analysis

It is critical to keep up with both global and local economic news. Vietnamese traders should regularly monitor economic data, geopolitical developments, and other pertinent news.

Furthermore, this continual analysis aids in forecasting market fluctuations and changing trading tactics as needed.

Best Forex Strategies for Vietnamese Traders Revealed

Fibonacci Retracement Strategy

This method uses Fibonacci levels to detect probable market reversal points. Traders can use these levels to anticipate where the price will pivot and continue its prior trend when the market retraces a portion of its action.

Harmonic Price Patterns

This sophisticated method entails detecting certain price patterns (such as the Butterfly, Bat, and Gartley) using Fibonacci numbers to forecast future price changes. It is best suited for experienced traders and necessitates a thorough comprehension of chart patterns.

Divergence Trading

Divergence trading happens when the price of a currency pair moves in the opposite direction of an oscillator (such as RSI or MACD). This could indicate a possible reversal. Vietnamese traders can use divergence to enter or exit transactions in anticipation of a shift in market direction.

Carry Trade Strategy

This technique entails borrowing in a low-interest-rate currency and investing in a higher-interest-rate currency. A profit can be made from the difference in interest rates (the “carry”).

Therefore, Vietnamese traders must know global interest rate patterns and possible unexpected currency reversals.

Scalping

Scalping involves conducting numerous small trades within a day, aiming to profit from each trade by capturing a few pips. This strategy suits traders who can dedicate sufficient time to observe market movements and swiftly make informed decisions.

Swing Trading

Swing traders seek to profit from price “swings” or moves that occur over days to weeks. They employ technical analysis to identify potential entry and exit points, sometimes supplemented with fundamental analysis to comprehend the underlying market dynamics.

Spot, Forwards, and Futures in Forex Trading

Spot Market

Spot Market Overview

Operating under the moniker “spot market” or colloquially as “spot,” this domain streamlines instant currency trade. When engaged in a spot transaction, currency exchange transpires precisely two days after the trade is finalized, distinguishing this approach with its rapid execution attribute.

Spot Market – Real-Life Example for Vietnamese Traders

If a Vietnamese trader believes the Euro would strengthen versus the US dollar. They choose to purchase EUR/USD at the current spot rate.

For instance, they would pay $118,500 if they purchased €100,000 at a rate of 1.1800 at the time. If their forecast is true and the EUR increases, they can profit by selling their €100,000 for more than $118,000.

Forwards Market

Forwards Market Overview

In the Forex market, a forward contract locks in the price at which an entity can purchase or sell a currency on a future date. Instead of spot transactions, forward contracts allow parties to designate a precise date in the future for settlement.

This type of contract is useful for firms and traders that want to protect themselves from potentially negative exchange rate swings.

Forwards Market – Real-Life Example for Vietnamese Traders

A company in Vietnam knows it will get USD from a client in three months, but it will require EUR for its European operations.

They can enter a forward contract to convert the USD they will receive into EUR at a fixed rate in three months. They are covered if the USD falls against the EUR throughout that timeframe.

Futures Market

Futures Market Overview

Futures contracts are standardized agreements to buy or sell a specific asset, like currency, at an agreed-upon price on a future date. Unlike forwards, futures are traded on exchanges with uniform contract sizes and maturity dates.

Futures Market – Real-Life Example for Vietnamese Traders

A Vietnamese trader expects the GBP to fall in value versus the USD during the next six months. They decide to sell (or “short”) a GBP/USD futures contract to profit from this belief.

If the GBP weakens against the USD when the contract expires, the trader will profit from the difference between the price at which the futures contract was sold and the lower market price of the GBP/USD at the contract’s expiration.

An Introduction to Forex Brokers

Forex brokers act as go-betweens for individual traders and the broad, often volatile, currency markets. They give traders access to a trading platform where they may buy and sell foreign currencies.

With its quickly rising economy and growing integration into global finance, the function of Forex brokers has become even more critical in Vietnam. They provide not only platforms in Vietnamese but also localized services, recognizing Vietnamese traders’ distinct needs and goals.

What is the Role of a Forex Broker?

The fundamental function of a Forex broker is to link Vietnamese traders to worldwide currency markets. They accomplish this by providing a platform for traders to execute their trades. However, their importance extends beyond simply providing a forum.

They provide leverage, allowing traders to handle greater positions with a smaller investment. This can raise possible rewards but also increases hazards.

Furthermore, brokers provide Vietnamese traders tools and resources such as market analyses, educational materials, and trading seminars.

They guarantee that traders have the knowledge and tools to make informed selections. They also keep traders’ funds, assure their safety and security, and process withdrawal requests.

How do Forex Brokers Make Money?

Forex brokers operate under a distinct business model. One of the keyways they make money is through the “spread.” The spread is the difference between a currency pair’s purchase (bid) and selling (ask) prices.

For example, the spread on the EUR/USD pair is 5 pips if the bid price is 1.1800 and the ask price is 1.1805. When Vietnamese traders enter a trade, they effectively “pay” this spread to the broker.

Commissions are another source of income for brokers. Some brokers charge a flat fee for each trade made on their platform. This fee is frequently transparent and is either a fixed amount or a percentage of the trade volume.

Furthermore, brokers who provide leverage profit from the interest rate disparity between the two currencies in a trade. This is also known as the “rollover” or “swap” rate.

Depending on the interest rate differential, a Vietnamese trader will receive or pay a modest charge if they hold a position overnight.

Finally, some brokers profit by providing extra services such as premium research, enhanced trading tools, or higher-tier account types with greater features.

Ask and Bid Price in Forex Trading

A thorough awareness of price intricacies is a crucial prerequisite for Vietnamese traders. The Ask and Bid prices are nestled amid these intricacies, serving as the essential variables guiding each transaction completed inside the vast Forex market.

Ask Price

Overview

The Ask price, also called the “Offer” price, represents the minimum amount a seller is willing to accept for a currency pair. It denotes the expense incurred by traders when acquiring a particular currency.

The Ask price consistently exceeds the market value slightly. Like Bid prices, this discrepancy guarantees brokers’ ability to meet their operational expenses and generate profits.

Bid Price

Overview

The Bid price is the most a buyer is willing to pay for a currency pair. Simply put, it is the price at which a trader can sell a currency.

Vietnamese traders must understand that the Bid price is always slightly lower than the market’s actual trading price. This distinction enables brokers and other market makers to continue operating profitably.

Spread and Pips in Forex Trading

Navigating the Forex market necessitates Vietnamese traders becoming acquainted with its distinct jargon. “Spread” and “Pips” are two of the most important phrases.

These words are essential for comprehending the cost structures in Forex trading and can substantially impact a trader’s profitability.

Spread

The spread is the difference between a currency pair’s Ask and Bid prices. It denotes the broker’s profit margin (net of commissions or fees). For traders, the spread is a cost of transacting. A narrower spread suggests a more liquid market, whereas a broader spread indicates less liquidity.

For example, the spread on the GBP/JPY pair is 5 pips if the Bid price is 150.00 and the Ask price is 150.05. Vietnamese traders would need the market to move in their favour by at least 5 pips to break even on this transaction.

Pips

A Pip (Percentage in Point) is the smallest price movement in the Forex market. A pip is the fourth decimal place (0.0001) for most currency pairs. However, for Japanese Yen pairs, a pip is normally the second decimal point (0.01).

Pips are a defined unit of measurement for measuring price movements and expressing the spread. Understanding pips is critical for Vietnamese traders when calculating profit and loss.

For example, if a trader purchases the AUD/CAD pair at 0.9500 and sells it at 0.9520, they have made a 20-pip profit.

An Introduction to Day Trading

Overview

Day trading is a fast-paced and dynamic trading strategy in which financial products are bought and sold on a single trading day. The basic purpose is to profit from minor price fluctuations in highly liquid marketplaces.

Day trading offers quick earnings for Vietnamese traders but also comes with its own set of hurdles and hazards.

Key Features of Day Trading

- Day traders open and terminating positions within the same day, ensuring that no open positions are held overnight to prevent potential risks from overnight market changes.

- Day traders frequently execute multiple transactions daily, capitalizing on modest price fluctuations.

- Many day traders use leverage to increase their prospective gains. However, leverage raises the possibility of loss, making risk management critical.

Indicators Commonly Used in Day Trading

- Averages: These aid in trend identification by averaging prices over several periods.

- RSI (Relative Strength Index): This momentum oscillator detects overbought or oversold conditions by measuring the pace and change of price movements.

- MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that depicts the relationship between two asset price moving averages.

- Bollinger Bands: These bands comprise an N-period simple moving average (SMA) in the center and an upper and lower band.

Real-Life Example for Vietnamese Traders

- Minh is a Vietnamese trader interested in trading the GBP/JPY currency pair.

- On one specific day, he notes that the pair is gaining strength due to UK economic news.

- Minh detects that the RSI has crossed over 70, suggesting a potential overbought condition, using the momentum trading approach and the RSI indicator.

- Minh enters a short position, believing the price will fall, anticipating a short-term turnaround.

- He closely analyses the transaction throughout the day, utilizing Bollinger Bands to evaluate volatility and potential exit points.

- The GBP/JPY pair has certainly retraced some of its gains by the conclusion of the trading day, and Minh cancels his position, collecting a profit.

An Introduction to Scalping in Forex Trading

Overview

Scalping is a trading method that aims to profit on minor price swings in the market. It’s like a fast-paced tango with the market, with traders making multiple minor daily trades.

Scalping provides the opportunity for quick trades for Vietnamese traders, but it also requires quick decision-making, precision, and a great awareness of market micro-movements.

Key Features of Scalping Trading

- Scalpers often hold positions for a few minutes or even seconds. The idea is to capture little price swings and exit the trade swiftly.

- Scalpers can make dozens, if not hundreds, of trades daily, profiting on even the smallest market changes.

- Due to the fast-paced nature of scalping, traders must make judgments quickly, frequently depending on real-time charts and quick reflexes.

- In scalping, each transaction seeks a little profit. However, the total return from numerous deals can be substantial.

Indicators Commonly Used in Scalping Trading

- MACD (Moving Average Convergence Divergence): This indicator is useful for detecting potential price reversals in short time frames.

- Stochastic Oscillator: Aids scalpers in identifying overbought or oversold market circumstances.

- Moving Averages: These can assist scalpers in identifying short-term trends and probable entry or exit locations.

- Bollinger Bands: These bands can detect times of low volatility and potential breakout events.

Real-Life Example for Vietnamese Traders

- Bao is a Vietnamese trader specializing in scalping the GBP/JPY forex pair.

- On one specific day, he detects greater volatility due to UK economic data releases.

- On a 1-minute chart, Bao uses the Bollinger Bands and Stochastic Oscillator to identify a probable overbought position when the price approaches the upper Bollinger Band.

- Bao enters a short position in anticipation of a small pullback.

- The price has retraced marginally within a few minutes, approaching the middle Bollinger Band.

- After noticing the Stochastic Oscillator moving away from the overbought zone, Bao promptly exits his account, collecting a little profit.

- Throughout the day, Bao performs similar deals several times, capturing a few pips and adding to a significant gain by the end of the trading session.

Base and Quote Currencies in Forex Trading

Every Forex transaction involves the simultaneous purchase of one currency and the sale of another. This dual nature of transactions is symbolized by a currency pair comprising two currencies: the Base Currency and the Quote Currency.

Understanding these words is critical for anyone starting Forex trading because they form the foundation of every deal and impact trading decisions.

What is the Base Currency?

The Base Currency of a currency pair is the first listed currency, representing the one being bought or sold to another currency. When examining a price chart or obtaining a quote for a specific currency pair, the value indicates how much one unit of the Base Currency is valued in terms of the Quote Currency.

For instance, if you come across a quoted currency pair at 1.2000, one Euro (the Base Currency) is equivalent to 1.2000 US Dollars (the Quote Currency).

What is the Quote Currency?

The Quote Currency, often known as the “counter currency,” is the second currency in a currency pair. It denotes the amount required to exchange for one unit of the Base Currency. In essence, the Quote Currency measures the value of the Base Currency.

Continuing with the previous example of EUR/USD at 1.2000, the Quote Currency (USD) informs us that 1.2000 US Dollars are required to purchase 1 Euro.

The Importance of Market Sentiment in Forex Trading

Understanding market sentiment is similar to determining the market’s emotional pulse. It gives traders an insight into how most participants perceive the future direction of a specific currency or currency pair.

Understanding market mood is a significant tool for Vietnamese traders, supplementing technical and fundamental studies and providing a more comprehensive perspective of market dynamics.

What is Market Sentiment?

Market sentiment, often known as “investor sentiment,” is the overall attitude or mood of investors toward a specific financial market or currency pair.

It collectively estimates traders’ and investors’ optimism or pessimism based on current events, economic data, geopolitical developments, and other significant elements.

Why is Market Sentiment Important for Vietnamese Traders?

- Understanding market emotion can help Vietnamese traders set more efficient stop-loss and take-profit levels, ensuring they are in sync with the overall market attitude.

- Informed Decision-Making: By evaluating sentiment, traders can make better-informed judgments, either following the current sentiment or taking a contrarian approach if they believe the market sentiment is skewed and needs correction.

- Predicting Trend Reversals: Excessive optimism or pessimism can frequently predict probable market reversals. For example, if most traders are optimistic about a currency, it may be nearing its top, signalling a possible downturn.

- Beyond the Numbers: While technical analysis is concerned with charts and indicators, and fundamental analysis is concerned with economic facts, market sentiment adds a third dimension by capturing the psychological and emotional variables that drive market movements.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

The Importance of Market Sentiment in Forex Trading

Understanding market sentiment is similar to determining the market’s emotional pulse. It gives traders an insight into how most participants perceive the future direction of a specific currency or currency pair.

Understanding market mood is a significant tool for Vietnamese traders, supplementing technical and fundamental studies and providing a more comprehensive perspective of market dynamics.

What is Market Sentiment?

Market sentiment, often known as “investor sentiment,” is the overall attitude or mood of investors toward a specific financial market or currency pair.

It collectively estimates traders’ and investors’ optimism or pessimism based on current events, economic data, geopolitical developments, and other significant elements.

Why is Market Sentiment Important for Vietnamese Traders?

- Understanding market emotion can help Vietnamese traders set more efficient stop-loss and take-profit levels, ensuring they are in sync with the overall market attitude.

- Informed Decision-Making: By evaluating sentiment, traders can make better-informed judgments, either following the current sentiment or taking a contrarian approach if they believe the market sentiment is skewed and needs correction.

- Predicting Trend Reversals: Excessive optimism or pessimism can frequently predict probable market reversals. For example, if most traders are optimistic about a currency, it may be nearing its top, signalling a possible downturn.

- Beyond the Numbers: While technical analysis is concerned with charts and indicators, and fundamental analysis is concerned with economic facts, market sentiment adds a third dimension by capturing the psychological and emotional variables that drive market movements.

The Effects of Leverage on Forex Trading

Leverage refers to the capacity to control a substantial trading position by employing minimal capital. Typically, it is conveyed as a ratio such as 50:1, indicating that traders have the potential to maintain positions valued at $50 for every $1 available in their account.

Pros of Using Leverage

- Capital Efficiency: Traders can control huge holdings without committing much capital. Diversification is possible since traders can start several positions with limited cash.

- Access to Larger Markets: For retail traders with minimal capital, leverage allows them to participate in otherwise inaccessible markets.

- Higher Potential Returns: Leverage can increase profitability. In a leveraged position, a modest price movement can result in substantial returns relative to the initial capital outlay.

Cons of Using Leverage

- Overtrading Risk: Because traders can control huge holdings with little capital, they may be enticed to take on excessive risk or open positions without adequate examination.

- Amplified Losses: While leverage can increase profits, it can also increase losses. Even minor price movements might result in large losses in a leveraged position.

- Margin Calls: If the market swings drastically against a trader’s position, brokers may issue a margin call, compelling the trader to deposit more funds or terminate the position.

Effects of Leverage on Vietnamese Traders

- Currency Volatility: Given the volatility of certain currency pairs that may interest Vietnamese traders, leverage can result in sudden and considerable changes in account balances.

- Economic Factors: Economic events like interest rate adjustments or trade balance reports can cause currency swings in Vietnam. When trading with leverage, these swings might disproportionately impact trade outcomes.

5 Best Forex Brokers in Vietnam with Free VPS Hosting

IC Markets

IC Markets promotes Equinix data centre VPS providers, specifically Equinix NY4. Traders with monthly volumes of more than 15 lots are eligible for sponsored VPS subscriptions. ForexVPS.net and Beeks Forex VPS, for example, ensure consistent connections to trading servers.

Exness

Exness provides strategically positioned VPS hosting close to their MT servers, allowing for quick and secure global trading. Traders adjust EA performance to ensure it runs smoothly regardless of internet stability.

Furthermore, eligibility for Exness VPS includes a free margin of more than $100 and a deposit of more than $500.

Pepperstone

Pepperstone collaborates with FXVM and New York City Servers for affordable VPS options. VPS ensures continuous trading, skilled adviser support, and robust backup systems.

AvaTrade

AvaTrade expands free VPS options while emphasizing dependability and stability. Their VPS provides quick trade execution while reducing delays and ensuring security. Features vary; further information is accessible on the official website or through customer care.

HFM

HFM works with Beeks Financial Cloud to provide free VPS hosting customized to the needs of traders. Their collaboration offers low latency for smooth transactions. HFM boosts performance via low-latency VPS solutions, which are available for free or for $30 per month.

MetaTrader 4 VS MetaTrader 5

Overview

- MetaTrader 4 (MT4): Since its inception in 2005, MT4 has become the global standard for Forex trading. It’s well-known for its easy-to-use interface, powerful charting features, and a large marketplace of third-party plugins and scripts.

- MetaTrader 5 (MT5): Introduced in 2010, MT5 is an upgrade to MT4 and a whole new platform. While it keeps many of the capabilities of MT4, it is intended to offer assets other than Forex, such as stocks and commodities.

Market Access

- MT4: Designed mostly for Forex trading. Traders can, however, access some CFDs with the correct broker.

- MT5: Provides a wider range of assets. Vietnamese traders can access equities, commodities, and futures in addition to Forex, making it a more adaptable platform for those wishing to diversify their portfolios.

Timeframes

- MT4: Provides nine timeframes, spanning from one minute to one month, to accommodate the majority of Forex trading techniques.