LiteFinance Review

Overall, LiteFinance is considered an average risk, with an overall Trust Score of 76 out of 100. LiteFinance is licensed by zero Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and zero Tier-3 Regulators (low trust). The broker offers Vietnamese traders three retail accounts: CENT, CLASSIC, and ECN.

- Lesche Duvenage

Jump to:

Overview

Regulation and Safety of Funds

Awards and Recognition

Account Types and Features

Account Registration

Broker Comparison

Trading Platforms

Range of Markets

Fees

Deposit and Withdrawels

Education and Research

Bonuses and Promotions

Affiliate Programs

Customer Support

Social Responsibility

Final Verdict

Pros and Cons

FAQ

Min Deposit

USD 10 / 243449 VND

Regulators

CySEC

Trading Desk

MT4, MT5, Web-based

Crypto

Yes

Total Pairs

40

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overview

The broker has been in business since 2005 as a Forex and CFD broker. Electronic Communications Network (ECN) trading is available through the broker in all major forex currency pairs. CLASSIC, ECN, and CENT accounts are available.

The CLASSIC and ECN accounts have a leverage of up to 1:1000, while the CENT account has a leverage of up to 1:200. USD and EUR are the account base currencies supported on all account types.

They provide a variety of trading platforms, including cTrader, mobile apps, MT4 and MT5.

The ECN account provides increased quoting precision, market execution, and no requotes, Stop and limit levels. News trading, hedging, and scalping are permitted, trades are delivered directly to liquidity providers, and no conflicts of interest exist.

Furthermore, the CLASSIC account provides improved quoting precision, market execution, and no requotes or stop and limit levels. Islamic accounts are available.

The broker offers instant crediting and withdrawal of funds with no limit on the amount and deposits them into your trading account.

In addition, LiteFinance provides various affiliate programs, including a multi-level system, cashback, and automatic reimbursement of commissions paid when replenishing and withdrawing funds.

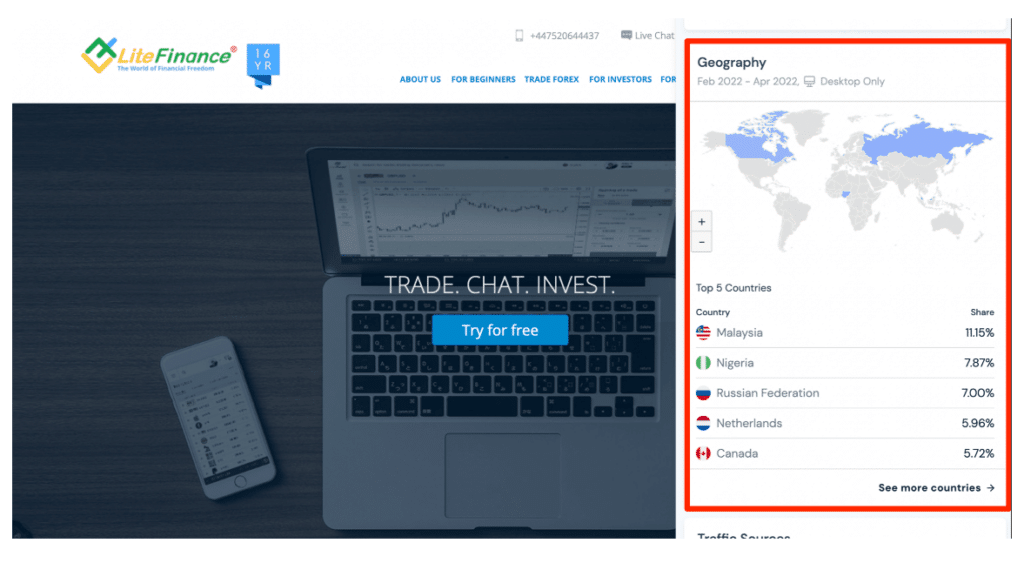

Distribution of Traders

Top 3 LiteFinance User Reviews

- Mason Duong (September 2023) “LiteFinance efficiently verified my account. Their sales team demonstrated professionalism and proficiency, surpassing my anticipations. I endorse their services wholeheartedly. Additionally, they offer a swift, straightforward, and dependable method for deposits and withdrawals.”

- Lily Vuong (September 2023) “LiteFinance is a reputable and secure broker, providing commendable forex trading services. Their operations are swift and trustworthy. Notably, they are among the few brokers that maintain a live chat room on their website, facilitating customer interactions and the exchange of trading insights.”

- James Phan (July 2023) “I have been associated with LiteFinance since 2014 and am thoroughly pleased with the services rendered. I particularly appreciate the prompt automatic fund withdrawals, user-friendly web terminal, mobile application, competitive spreads on ECN accounts, and optimal trading performance.”

Advantages that LiteFinance has over competitors

- LiteFinance provides CENT, ECN, and CLASSIC accounts to accommodate various types of traders and their preferences.

- Aside from their mobile platform, they also offer the popular cTrader, MetaTrader 4 and MetaTrader 5 trading platforms.

- LiteFinance provides access to over 150 assets, including currency pairs, metals, oil, CFDs on blue-chip stocks in the United States and Europe, and stock indices.

- Since 2005, LiteFinance has provided clients access to various liquid assets such as currency, commodity, stock, and cryptocurrency markets.

- LiteFinance, a globally recognized high-tech broker, employs ECN technology, giving clients access to tight raw spreads and some of the lowest fees. Transactions are carried out instantly, with no slippage or requotes.

- Traders can profit from their copy trading system, allowing them to mimic experienced traders’ actions.

- Traders can automatically withdraw up to $5000 per day through various popular payment systems.

- Deposits and withdrawals are free of charge at LiteFinance.

- This service streamlines trading in MetaTrader terminals by allowing traders to set parameters for opening and closing positions to complete transactions quickly.

- Their trading platform has a user-friendly interface and is available in 23 languages, allowing them to cater to a global clientele.

- They assign a personal manager to each client and offer a support service available 24 hours a day, seven days a week. Their awards include “Best Customer Service” and “Best Broker.”

- Trade requests are routed to liquidity providers via ECN technology, ensuring instant execution at the best prices with no delays or slippages. Their commission rates are among the lowest in the Forex market.

- Islamic Swap-Free accounts provide all the benefits of other trading accounts but does not charge swap fees for position transfers to the following day.

- LiteFinance offers free educational materials, daily analytics, video reviews, and trading signals.

- They frequently hold regional contests for clients and partners worldwide, with winners receiving cash and valuable prizes.

Who will Benefit from Trading?

- With access to over 150 assets, including currencies, commodities, stocks, and cryptocurrencies, LiteFinance is an ideal platform for traders looking for a diverse trading portfolio.

- Those who trade for the long term can benefit from the broker’s in-depth market analyses and research tools, which can help them make informed decisions.

- Traders who want to comply with Sharia law by avoiding swap charges for position transfers to the next day can use LiteFinance’s Islamic swap-free accounts.

- Those looking to earn money through partnerships can take advantage of LiteFinance’s affiliate programs, which offer competitive commission structures and promotional materials.

- Those who prefer replicating successful traders’ trading strategies can benefit from LiteFinance’s copy trading system. This enables less experienced traders to profit by imitating the actions of market experts.

- Financial institutions looking for a dependable broker with cutting-edge trading technologies and a diverse portfolio of assets will find LiteFinance a good fit.

- Beginners can benefit from LiteFinance’s educational resources, which include webinars, tutorials, and daily market analyses. The user-friendly platform interface also aids newcomers in navigating and comprehending the trading environment.

- Advanced traders can benefit from LiteFinance’s ECN technology, tight spreads, and instant execution. The broker’s diverse trading tools and assets allow experienced traders to diversify their portfolios.

- With the one-click trading feature and instant execution, traders operating on short time frames or making multiple trades daily can benefit from LiteFinance’s efficiency and speed.

- Those who prefer to trade on the go can use LiteFinance’s mobile application, which has the same features as the desktop version.

What sets LiteFinance apart from other brokers?

The broker stands out by combining diverse account types, cutting-edge trading platforms, and a robust affiliate program.

Is there any advantage in terms of account types?

Yes, they provide a variety of account types, including CENT, CLASSIC, and ECN, to meet various trading needs.

LiteFinance At a Glance

| 🏛 Headquartered | Limassol, Cyprus |

| 🌎 Global Offices | Cyprus |

| 🏛 Local Market Regulators in Vietnam | The State Bank of Vietnam (SBV) ) |

| 💳 Foreign Direct Investment in Vietnam | 22.40 Billion USD (Dec 2022) |

| 💰 Foreign Exchange Reserves in Vietnam | 85,801 million USD (Feb 2023) |

| ✔️ Local office in Hanoi? | No |

| 👨⚖️ Governor of SEC in Vietnam | SBV Governor, Nguyen Thi Hong |

| ✔️ Accepts Vietnamese Traders? | Yes |

| 📊 Year Founded | 2005 |

| 📞 Vietnam Office Contact Number | None |

| 📱 Social Media Platforms | Facebook Telegram YouTube RSS Feed |

| ⚖️ Regulation | CySEC |

| 1️⃣ Tier-1 Licenses | None |

| 2️⃣ Tier-2 Licenses | Cyprus Securities and Exchange Commission (CySEC) |

| 3️⃣ Tier-3 Licenses | None |

| 🪪 License Number | Cyprus – 093/08 |

| ⚖️SBV Regulation | None |

| ✔️ Regional Restrictions | The United States, Israel, Japan, Russia, and some other countries |

| ☪️ Islamic Account | Yes |

| 💻 Demo Account | Yes |

| 🛍 Retail Investor Accounts | 3 |

| ✔️ PAMM Accounts | Yes |

| 💻 Liquidity Providers | Unknown |

| ✔️ Affiliate Program | Yes |

| 📱 Order Execution | Market |

| 📊 Starting spread | 0.0 pips, Variable |

| 📉 Minimum Commission per Trade | $0.25 per share |

| 💰 Decimal Pricing | 5th Decimal after the comma |

| 📞 Margin Call | 100% |

| 🛑 Stop-Out | 20% |

| 📉 Minimum Trade Size | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots |

| ✅ Crypto trading offered? | Yes |

| ✔️ Offers a VND Account? | No |

| 📉 Dedicated Vietnamese Account Manager? | No |

| 📈 Maximum Leverage | 1:1000 |

| 📊 Leverage Restrictions for Vietnam? | No |

| 💳 Minimum Deposit (VDN) | USD 10 / 243449 VND |

| ✔️ Vietnam Dong Deposits Allowed? | No |

| 📊 Active Vietnam Trader Stats | 90 million+ |

| 👥 Active Vietnam-based LiteFinance customers | Unknown |

| 🔁 Vietnam Daily Forex Turnover | 9.9 billion USD (2019) |

| 💰 Deposit and Withdrawal Options | Credit/Debit Card Bank Wire Transfer Perfect Money M-PESA Kenya M-PESA Tanzania Africa Mobile Money ADVCash Cryptocurrencies |

| 💻 Minimum Withdrawal Time | Instant |

| ⏰ Maximum Estimated Withdrawal Time | Up to 5 working days |

| 💳 Instant Deposits and Instant Withdrawals? | No |

| 🏛 Segregated Accounts with Vietnamese Banks? | No |

| 📱 Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader LiteFinance App |

| 💻 Tradable Assets | Forex Commodities CFDs on Indices Energies Precious Metals Share CFDs |

| ✔️ Offers USD/VND currency pair? | No |

| 📊 USD/VND Average Spread | None |

| ✅ Offers Vietnamese Stocks and CFDs | No |

| 💻 Languages supported on the Website | English, Indonesian, Russian, Malay, Thai, Spanish, French, Portuguese, Chinese (Simplified), Arabic, Persian |

| ☎️ Customer Support Languages | Multilingual |

| 👥 Copy Trading Support | No |

| ⏰ Customer Service Hours | 24/5 |

| 📞 Vietnam-based customer support? | No |

| 💸 Bonuses and Promotions for Vietnamese? | Yes |

| 📚 Education for Vietnamese beginner traders | Yes |

| 📱 Proprietary trading software | Yes |

| 🤝 Most Successful Trader in Vietnam | Most Successful unknown, but the top include Dao Thi Kim Ngan, Tran Minh Tuan, Pham Quoc Dat, etc. |

| ✔️ Is the broker a safe broker for Vietnam Traders? | No |

| 🎖 Rating for Exness Vietnam | 7 /10 |

| 🥇 Trust score for Exness Vietnamese | 76% |

| 👉 Open Account | 👉 Open Account |

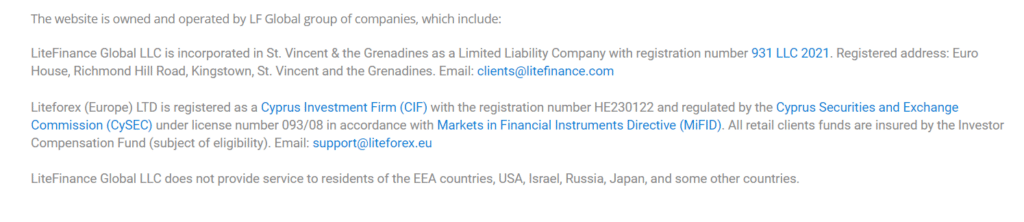

Regulation and Safety of Funds

The broker is not currently regulated by the State Bank of Vietnam (SBV). However, LiteFinance’s global regulations are listed in the table below.

Global Regulations

| Registered Entity | Country of Registration | Regulatory Entity | Tier |

| LiteFinance (Europe) LTD | Cyprus | CySEC | 2 |

Security while Trading

- LiteFinance has a separate privacy policy for mobile application users, emphasizing their commitment to preventing unauthorized access, disclosure, alteration, or destruction of user information.

- The broker has clear terms of service, privacy policies, risk disclosures, and AML/KYC policies. These documents give traders a clear understanding of how their data is used and the safeguards to protect it.

- LiteFinance Global LLC is based in St. Vincent and the Grenadines and follows strict regulatory guidelines. Furthermore, Liteforex (Europe) LTD is a Cyprus Investment Firm (CIF) and is governed by the Cyprus Securities and Exchange Commission (CySEC). Such regulatory oversight ensures that the broker follows strict operating standards and provides a secure trading environment for its clients.

- The Investor Compensation Fund insures all retail client funds for added security. This adds another layer of security to traders’ investments.

- The Client Profile section of LiteFinance, accessible via my.litefinance.org, is a secure website area that gives users access to all primary account operations. This ensures that all personal and financial information about clients is kept private and secure from unauthorized access.

- LiteFinance is open about the risks of trading on financial markets. They provide a thorough risk warning to educate traders about the potential risks of Contracts for Difference (CFDs) and the impact of leverage. This openness ensures that traders are well-informed before making trading decisions.

How often does LiteFinance update its security protocols?

To stay ahead of potential threats, LiteFinance reviews and updates its security measures regularly.

What security measures are in place for online transactions with LiteFinance?

To secure online transactions and protect user data, LiteFinance employs advanced encryption techniques.

Awards and Recognition

Received the following recent awards and recognition:

- Best ECN Broker of the Year in the Middle East

- Most Innovative Regional Forex Broker in Asia

- The most Innovative ECN Broker in the MENA region

- Best Retail Forex Broker, and many more.

What are some significant awards and recognitions that LiteFinance has received in the financial industry?

They have been honored with notable awards in the financial industry, highlighting its excellence in areas such as online trading, investment services, and client satisfaction.

How does LiteFinance’s recognition through industry awards contribute to its reputation and credibility?

The brokers recognition through industry awards significantly enhances its reputation and credibility as a leading financial service provider, emphasizing its dedication to offering exceptional services and maintaining high industry standards.

LiteFinance Account Types and Features

| 💻 Live Account | 💰 Minimum Dep. | 📊 Average Spread | ✔️ Commissions | 📈 Average Trading Cost |

| CENT | $10 / 244450 VND | 3 pips | Spread only | 30 USD |

| CLASSIC | $50 / 1217249 VND | 1.8 pips | Spread only | 18 USD |

| ECN | $50 / 1217249 VND | 0.0 pips | From $0.25 per lot | 0.25 USD |

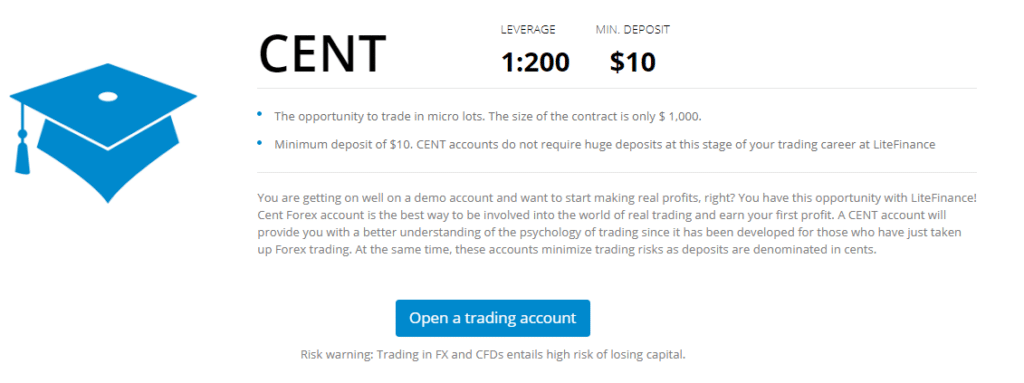

CENT Account

The CENT account is intended for traders new to the forex market and those who want to test their trading strategies in a real trading environment without putting a large sum of money at risk.

This account type allows traders to trade with micro-lots and requires a $10 minimum deposit. The CENT account provides up to 1:200 leverage, making it ideal for traders who prefer a lower-risk profile.

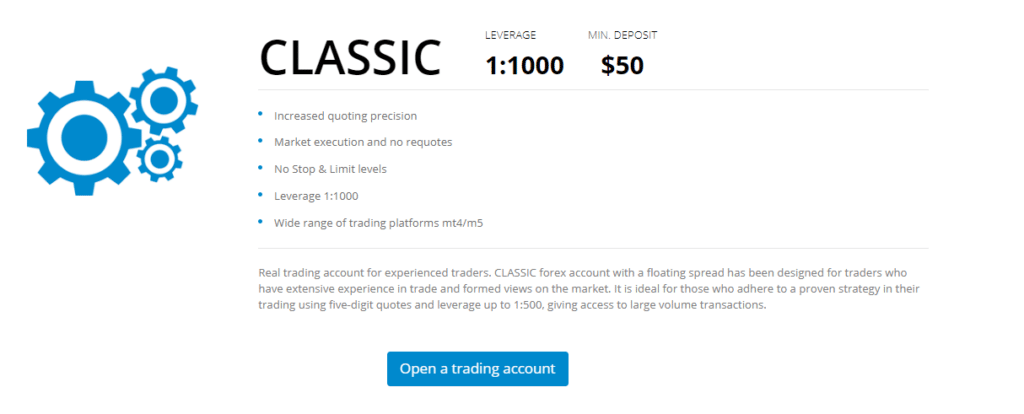

CLASSIC Account

The CLASSIC account is designed for both new and seasoned traders. Compared to the CENT account, it provides a broader range of financial instruments, including 56 currency pairs, 14 cryptocurrency pairs, metals, oil, and stock indices.

Traders can access leverage of up to 1:500 with a minimum deposit of $50. The CLASSIC account offers tight spreads starting at 1.8 pips and no commission on trades.

This account type also supports automated trading, and traders can automate their trading strategies with Expert Advisors (EAs).

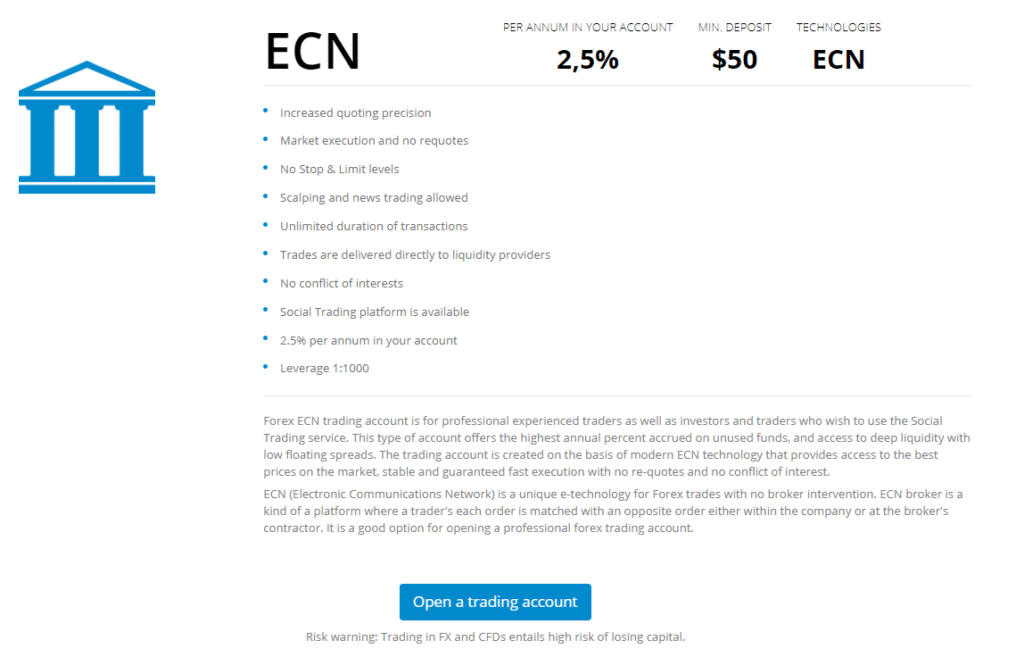

ECN Account

The ECN account caters to adept traders inclined towards high-frequency trading. For this account, a minimum deposit of $50 is required with leverage options up to 1:1000.

It provides enhanced quoting accuracy and efficiency through market execution without any requotes or restrictions on Stop or Limit levels.

Moreover, the ECN account entails minimal commission fees of only $0.25 per lot, along with spreads commencing at zero. Designed for professionals, it offers market spreads starting from 0 pips while ensuring instant order execution capabilities are in place.

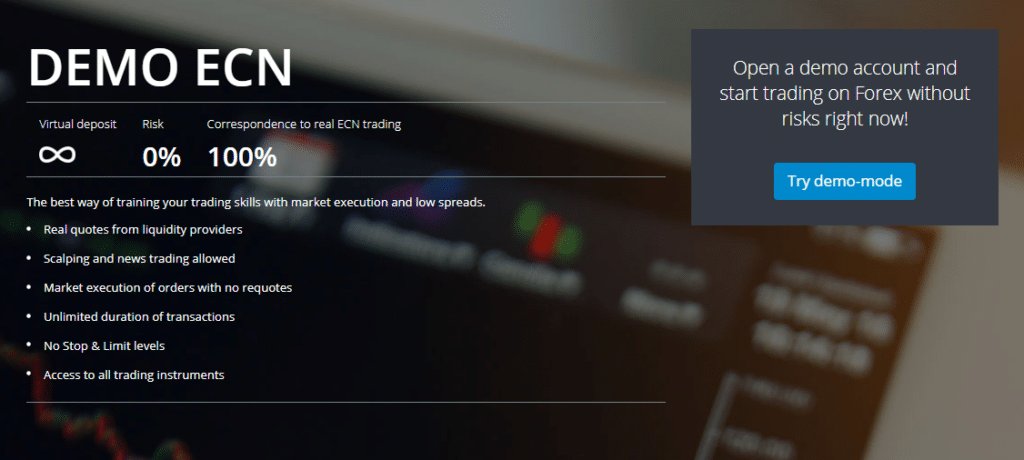

Demo Account

The Demo account is a training platform allowing novice and experienced traders to practice and hone their trading skills under real-world market conditions without the risk of actual financial loss.

This account is beneficial for practising with MetaTrader platforms, testing trading strategies, or experimenting with Expert Advisors (EAs) in a simulated environment. The funds in the demo account are fictitious, allowing traders to practice without financial risk.

One of the most notable features of the Demo account is its quick setup process, which allows traders to open an account in less than a minute via their Profile.

The Demo ECN account provides a virtual deposit and accurately replicates real ECN trading conditions. It provides traders with real-time quotes from liquidity providers, allows scalping and news trading, and ensures that orders are executed in the market without requotes.

Furthermore, there are no transaction time limits, and traders can access all trading instruments on the platform.

Islamic Account

LiteFinance provides an Islamic account, also known as a swap-free account, for clients who, due to religious beliefs, are not permitted to conduct monetary operations involving interest payments.

The Islamic account is designed to be Sharia-compliant and does not charge or pay interest. It is available for all accounts, including Classic and ECN accounts.

In terms of trading conditions, such as spreads, execution, and leverage, the Islamic account is similar to other accounts. It is important to note that it does not charge a rollover fee for carrying over open positions to the next day.

As a result, it is appropriate for traders who prefer to hold positions for longer periods without incurring additional costs.

The Islamic account offers several benefits, including Sharia law compliance, no rollover fees, and access to all trading instruments and platforms. It is an excellent option for traders who wish to trade per their religious beliefs.

Professional Account

LiteFinance does not offer a dedicated account to professional traders.

Spread Betting Account

LiteFinance does not provide spread betting to Vietnamese traders.

Base Account Currencies

The base account currencies available to Vietnamese include the following:

- USD

- EUR

Basic Order Types

- Market Order – A market order can be either a buy or a sell order that executes at the current market price. This is the current price displayed on your platform’s chart. If you place a market order, you will be immediately entered at the best available price.

- Market orders are most effective when a trading opportunity requires prompt action. Click buy/sell at market to enter the trade immediately.

- Stop Order – A stop order can be either a buy or sell stop, depending on whether you wish to purchase above or below the market.

- This is useful for trading breakouts or trend continuation strategies when you want the market to continue moving in the same direction.

- Limit Order – Alternatively, if you believe the price will reverse when it reaches a certain price, you can place a limit order.

- Limit orders can be either buy or sell limits, depending on the market’s direction before your anticipated reversal.

- A sell limit is used to sell above the market, while a buy limit is used to purchase below the market.

Do all account types offer access to the same trading instruments?

While LiteFinance strives to provide a diverse range of instruments, availability may vary depending on the account’s specific features.

Can I have multiple account types under one profile?

Yes, traders can maintain multiple account types.

How to open a LiteFinance Account – A Step-by-Step Guide

To open an account, Vietnamese can follow these steps:

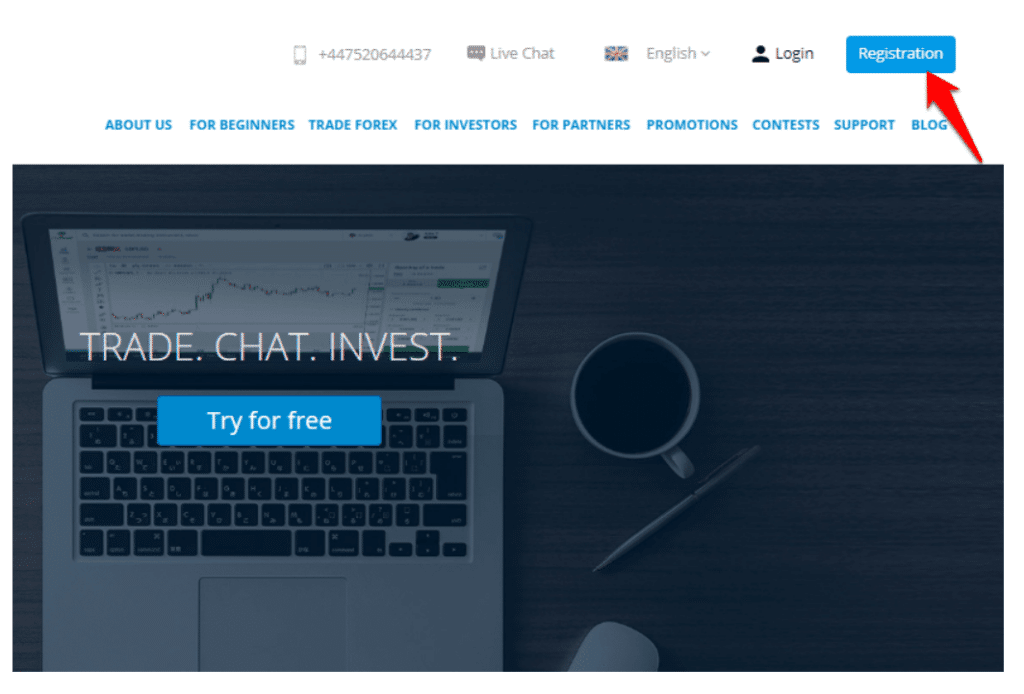

Step 1 – Navigate to the LiteForex website

The first step in registering for a account involves traders navigating to the LiteForex website, and clicking on “Register” to proceed.

Step 2 – Fill out the registration

The second step in the registration process requires traders to fill in their: email address, phone number, and password.

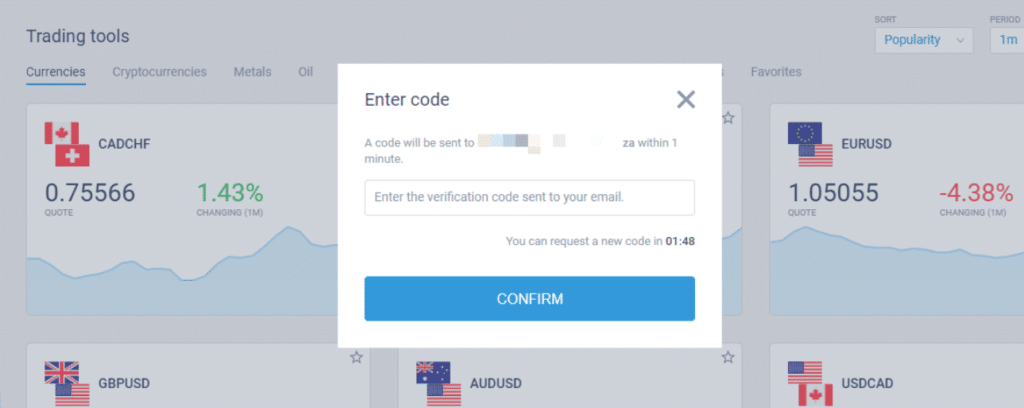

Step 3 – Access the trading dashboard and verify your email address.

Traders will now gain access to the trading dashboard where they can verify their personal information in order to start trading.

Can I start trading immediately after registration?

Yes, you can begin trading on the platforms once your account has been verified and your initial deposit has been made.

Is there a demo version available for practice before opening a live account?

Yes, they offer demo accounts, allowing traders to become acquainted with the platform without risking real money.

How to Close a LiteFinance Account

To close a live trading account with LiteFinance, Vietnamese traders can follow these steps:

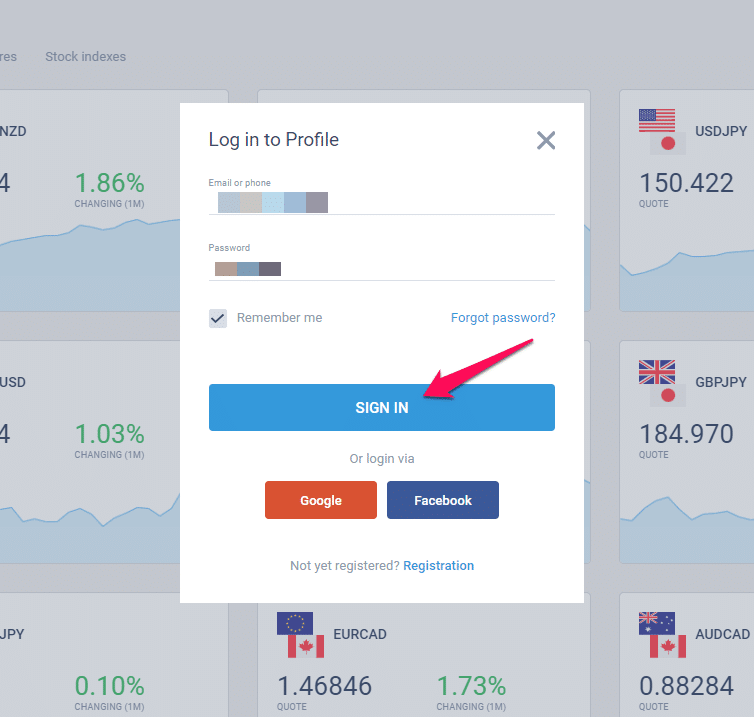

- Sign in to your account with your login information.

- Navigate to your account’s settings or profile section.

- Look for an option to close your account or submit a request to close your account.

- Follow provided instructions to close your account.

- If your account contains any open positions or funds, you may be required to close the positions and withdraw the funds before closing the account.

- Once your account has been closed, LiteFinance will send you a confirmation email.

What happens to any open trades when I request account closure?

Open trades should be closed, or they may be closed automatically if the account is terminated.

Can I transfer my account to another individual instead of closing it?

No, account transfers to other individuals are typically not permitted

LiteFinance Vs FxPro Vs InstaForex – Broker Comparison

| 🥇 LiteFinance | 🥈 FxPro | 🥉 InstaForex | |

| ⚖️ Regulation | CySEC | FCA, CySEC, SCB, FSCA, FSC | FCA, BVI FSC, CySEC, FSA SVG |

| 📱 Trading Platform | MetaTrader 4 MetaTrader 5 cTrader LiteFinance Trading App | MetaTrader 4 MetaTrader 5 cTrader FxPro App | MetaTrader 4 MetaTrader 5 WebIFX InstaForex multi-Terminal InstaForex WebTrader InstaTick Trader InstaForex MobileTrader |

| 💰 Withdrawal Fee | No | No | Yes |

| 📊 Demo Account | Yes | Yes | Yes |

| 📈 Minimum Deposit | USD 10 / 243449 VND | USD 100 (recommended amount USD 1000) / 2444503 VND | USD 1/ 4505 VND |

| 📊 Leverage | 1:500 | 1:500 | 1:1000 |

| 📊 Spread | 0.0 pips | From 0.0 pips EUR/USD | 0.0 pips |

| 💰 Commissions | $0.25 per share on Stock Indices | $3.5 per side | 0.03% to 0.07% |

| ✴️ Margin Call/Stop-Out | 100%/20% | 100%/50% | 30%/10% |

| 💻 Order Execution | Market | Market | Market |

| 💳 No-Deposit Bonus | No | No | Yes |

| 📊 Cent Accounts | No | No | Yes |

| 📈 Account Types | CENT CLASSIC ECN | Standard Account Pro Account Raw+ Account ECN Account | Insta.Standard Trading Account Insta.Eurica Trading Account Cent.Standard Trading Account Cent.Eurica Trading Account |

| ⚖️ SBV Regulation | None | No | No |

| 💳 VND Deposits | No | No | No |

| 📊 Vietnamese Dong Account | No | No | No |

| 👥 Customer Service Hours | 24/5 | 24/5 | 24/5 |

| 📊 Retail Investor Accounts | 2 | 4 | 4 |

| ☪️ Islamic Account | Yes | Yes | Yes |

| 📉 Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| 📈 Maximum Trade Size | 100 lots | Unlimited | 100 lots |

| 💰 Minimum Withdrawal Time | Instant | 1 business day | Instant |

| 📊 Maximum Estimated Withdrawal Time | Up to 5 working days | 7 business days s | Up to 6 working days |

| 💸 Instant Deposits and Instant Withdrawals? | Yes | Yes, Deposits | Yes |

Trading Platforms

offers Vietnamese traders a choice between these trading platforms:

- MetaTrader 4

- MetaTrader 5

- cTrader

- Trading App

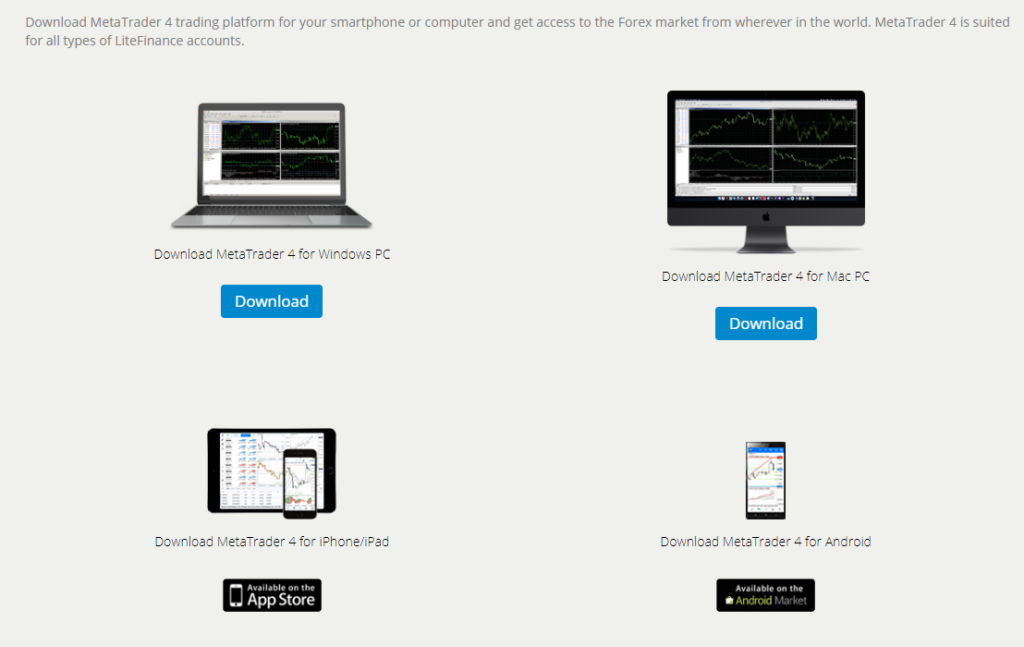

MetaTrader 4

MetaTrader 4 is suitable for both novice and experienced traders. It provides comprehensive tools, including advanced charting, technical analysis, and automated trading via Expert Advisors (EAs).

The MT4 traders have a smooth trading experience and can trade various financial instruments. The platform is also mobile-friendly, allowing traders to manage their positions while on the go.

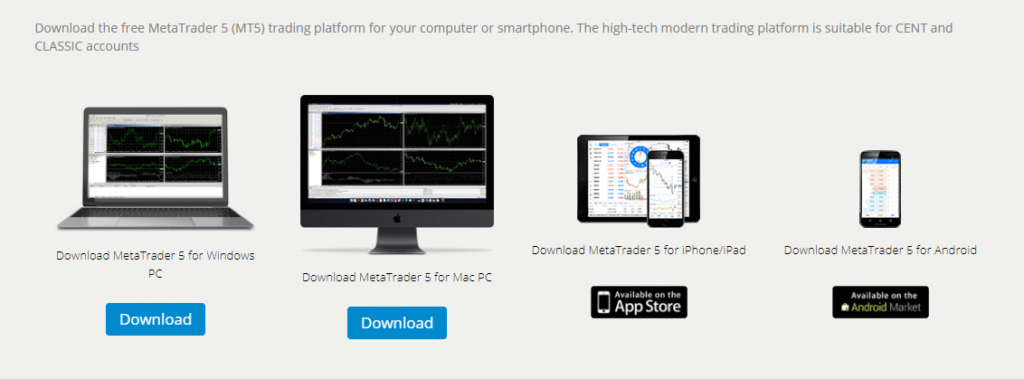

MetaTrader 5

The MetaTrader 5 platform has more timeframes, order types, an economic calendar, and a market depth feature. Furthermore, MT5 gives traders access to more financial markets, such as stocks and commodities.

MT5 is also available on mobile devices, as was its predecessor, ensuring that traders can always stay connected to the markets.

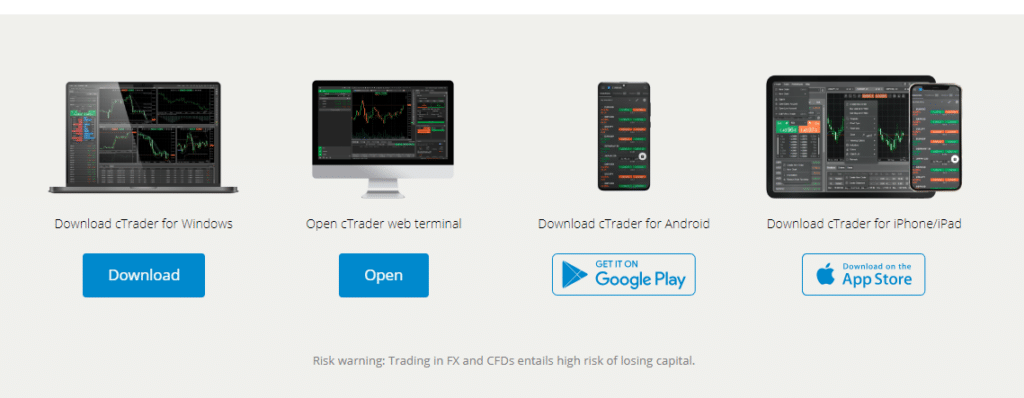

cTrader

cTrader is another platform known for its user-friendly interface and advanced trading capabilities. It gives traders Level II pricing and full market depth, making trading more transparent.

Advanced charting tools, multiple order types, and algorithmic trading capabilities are also available in cTrader. It is especially popular among those who prefer a more modern and user-friendly design.

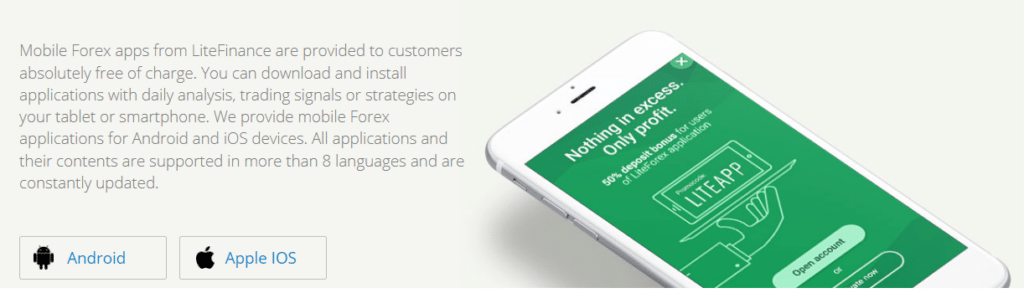

Trading App

They have created a mobile trading application so that traders can access the markets at any time and from any location. This app, available for Android and iOS devices, includes several features such as daily analysis, trading signals, and strategies.

It is multilingual and offers analytical support for various currency pairs, precious metals, and other trading instruments.

The app is designed to provide up-to-date analytical reviews 24 hours a day, seven days a week, ensuring that traders are always informed and prepared to make the best trading decisions.

How does LiteFinance ensure the security of its trading platform

The broker employs advanced encryption and security measures to protect user data and trading activities.

How do I access technical analysis tools on the platform?

The platforms include various technical analysis tools easily accessible from the interface.

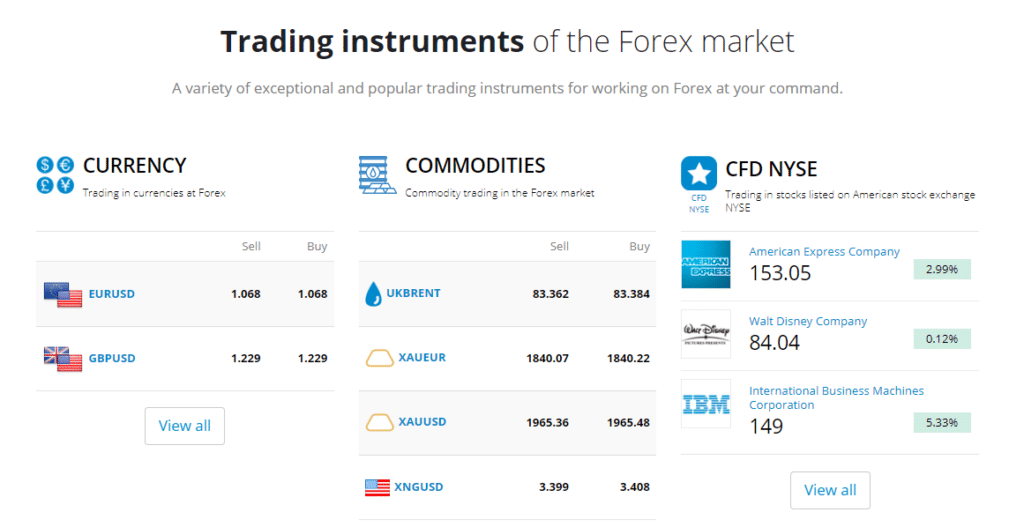

Range of Markets

Vietnamese traders can expect the following range of markets:

- Forex

- Precious Metals

- Energies

- Global Stock Indexes

- CFD NYSE

- CFD NASDAQ

- CFD EURONEXT

- CFD LONDON LSE

- CFD XETRA

Financial Instruments and Leverage offered

| 🔨 Instrument | 💰 Number of Assets Offered | 📈 Max Leverage Offered |

| ➡️ Forex | 57 | 1:1000 |

| ➡️ Precious Metals | 5 | 1:100 |

| ➡️ Energies | 2 | 1:100 |

| ➡️ Global Stock Indexes | 11 | 1:100 |

| ➡️ Stock CFDs | 100+ | 1:20 |

Are there any restrictions on trading certain instruments?

Yes, they strive to provide a diverse range of instruments, specific restrictions may apply due to regulatory or platform constraints.

Does LiteFinance offer any resources to understand market dynamics for specific instruments?

Yes, because the broker is dedicated to education, it will likely provide resources and insights to help traders understand various market dynamics.

Broker Comparison for Range of Markets

| 🥇 LiteFinance | 🥈 FxPro | 🥉 InstaForex | |

| ➡️️ Forex | Yes | Yes | Yes |

| ➡️️ Precious Metals | Yes | Yes | Yes |

| ➡️️ ETFs | No | No | No |

| ➡️️ CFDs | Yes | Yes | Yes |

| ➡️️ Indices | Yes | Yes | Yes |

| ➡️️ Stocks | Yes | Yes | Yes |

| ➡️️ Cryptocurrency | No | Yes | Yes |

| ➡️️ Options | No | No | No |

| ➡️️ Energies | Yes | Yes | Yes |

| ➡️️ Bonds | No | No | No |

Trading and Non-Trading Fees

Spreads

offers spreads that may vary and are flexible, as they can be adjusted depending on several factors, such as the financial instrument being traded, the account type chosen by the trader, and prevailing market conditions.

Commissions

The broker offers traders the lowest spreads possible on its ECN Account, thanks to its remarkably low commissions. This makes it an excellent option for day traders and other active investors who rely on short time frames and fluctuating market conditions in their scalping strategies.

The transaction fees charged vary depending on the financial asset being exchanged. Traders can anticipate commission fees as follows for their ECN Account:

- $0.25 per share

- $0.5 per Contract on Stock Indices

- $0.5 per lot on Energies

- $10 on Forex Major Pairs

- $20 on Forex Crosses

- $20 on Precious Metals

- $30 on Forex Minor Pairs

- 0.12% on Cryptocurrencies

Overnight Fees, Rollovers, or Swaps

The nightly rate is determined by considering the present situation in the market. Depending on various market conditions like volatility and interest rates, The broker can adjust its spreads and swaps whenever necessary.

Each day, at trading closure, daily overnight costs are calculated with extra triple swap charges applicable specifically on Wednesday and Thursday nights.

Deposit and Withdrawal Fees

does not charge any fees on deposits or withdrawals.

Inactivity Fees

If a trading account remains inactive for two months with an account balance below $100, there will be a charge of $10 imposed as an inactivity fee.

Currency Conversion Fees

Vietnamese traders depositing or withdrawing funds in currencies other than the designated base account currencies may be subject to currency conversion fees.

How does LiteFinance handle deposit and withdrawal fees?

The broker compensates for deposit transfer commissions, ensuring traders do not incur additional fees.

Are overnight or swap fees applicable on LiteFinance?

Yes, the broker, like most brokers, may charge overnight or swap fees, but the specifics depend on the instrument and account type.

LiteFinance Deposits and Withdrawals

offers Vietnamese traders the following deposit and withdrawal methods:

- Credit/Debit Card

- Bank Wire Transfer

- Perfect Money

- M-PESA Kenya

- M-PESA Tanzania

- Africa Mobile Money

- ADVCash

- Cryptocurrencies

Broker Comparison: Deposit and Withdrawals

| 🥇 LiteFinance | 🥈 FxPro | 🥉 InstaForex | |

| ⏰ Minimum Withdrawal Time | Instant | 1 business day | Instant |

| 💳 Maximum Estimated Withdrawal Time | Up to 5 working days | 7 business days | Up to 6 working days |

| 💰 Instant Deposits and Instant Withdrawals? | Yes | Yes, Deposits | Yes |

Deposit Currencies, Deposit and Withdrawal Processing Times

| 💳 Payment Method | 💳 Commission Charge | 💳 Min Deposit Amount |

| 💰 Debit Card | 0% | $10 |

| 💰 Credit Card | 0% | $10 |

| 💰 Local Deposits | 0% | $1 |

| 💰 Bank Wire Deposits | 0% | $100 |

| 💰 Perfect Money | 0% | $10 |

| 💰 M-PESA Kenya | 0% | $1 |

| 💰 M-PESA Tanzania | 0% | $1 |

| 💰 Africa Mobile Money | 0% | $10 |

| 💰 WebMoney | 0% | $10 |

| 💰 ADVCash | 0% | $10 |

| 💰 Bitcoin Cash (BCH) | 0% | $10 |

| 💰 Bitcoin (BTC) | 0% | $10 |

| 💰 Equity Bank Transfer | 0% | $10 |

| 💰 Ethereum (ETH) | 0% | $10 |

| 💰 Litecoin (LTC) | 0% | $10 |

| 💰 Monero (XMR) | 0% | $10 |

| 💰Ripple (XRP) | 0% | $50 |

Is there a minimum withdrawal amount on LiteFinance?

Yes, the broker likely has minimum withdrawal amounts.

Can I cancel a withdrawal request if it hasn’t been processed yet?

Yes, the broker allows traders to cancel withdrawal requests if they have not been processed, but certain terms and conditions might apply.

How to Deposit Funds

To deposit funds to an account, Vietnamese traders can follow these steps:

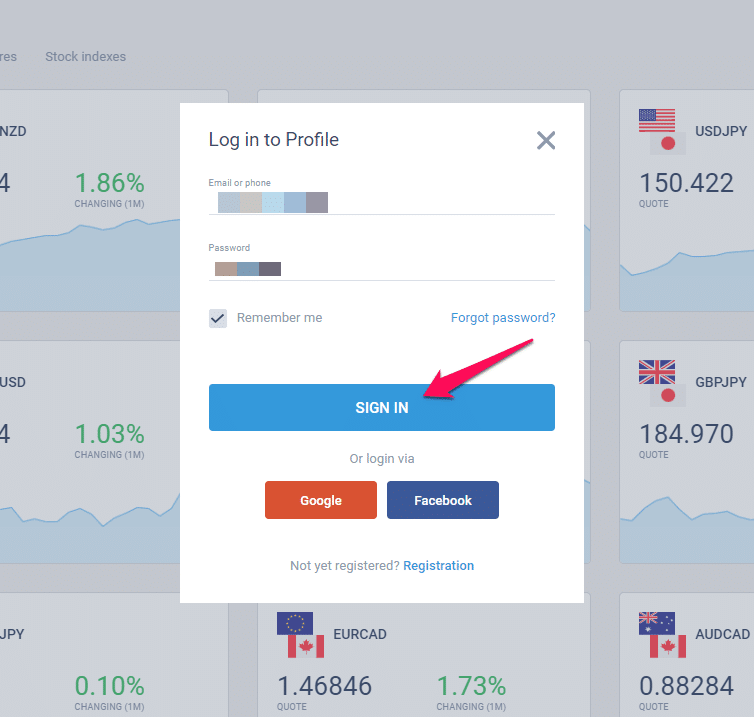

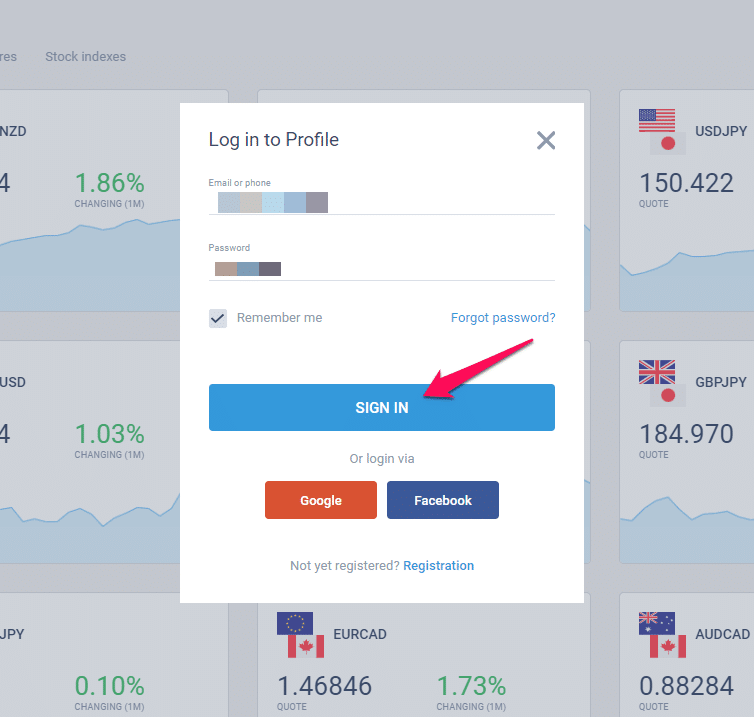

Step 1. Log in

Log in to your account with your login information.

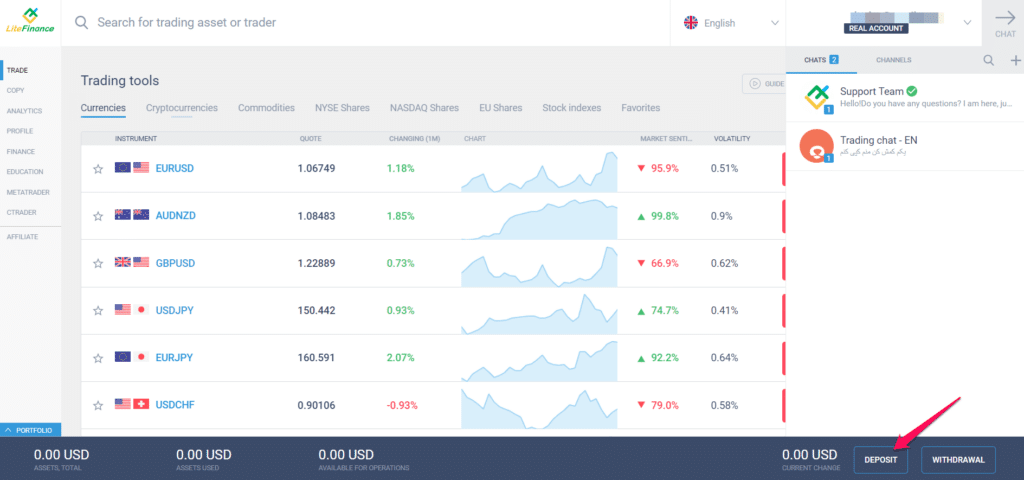

Step 2. “Deposit”

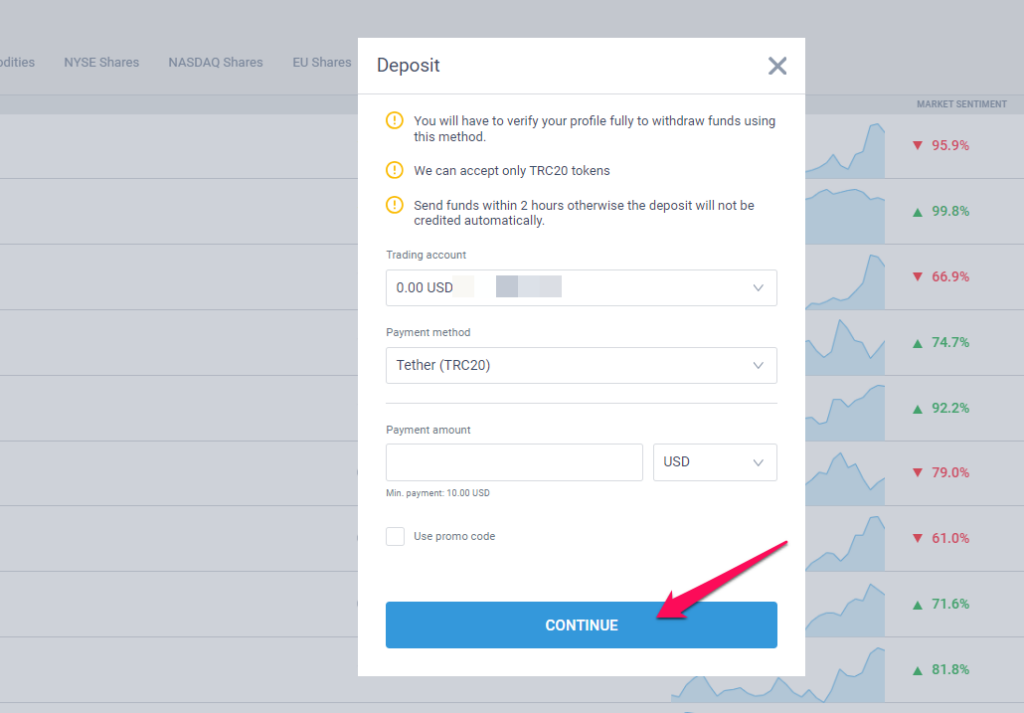

Navigate to your account’s “Deposit” section.

Step 3. Choose your preferred deposit method

Choose your preferred deposit method from a list that includes credit/debit cards, bank transfers, and e-wallets.

Enter the amount you want to deposit, and then follow the instructions to complete the transaction.

Once the deposit is confirmed, the funds will be credited to your account.

How quickly are deposited funds available for trading?

Deposits are usually processed quickly, ensuring that funds are available for trading with minimal delay.

Is it safe to deposit large amounts with LiteFinance?

The broker employs stringent security measures to protect traders’ funds during the deposit process.

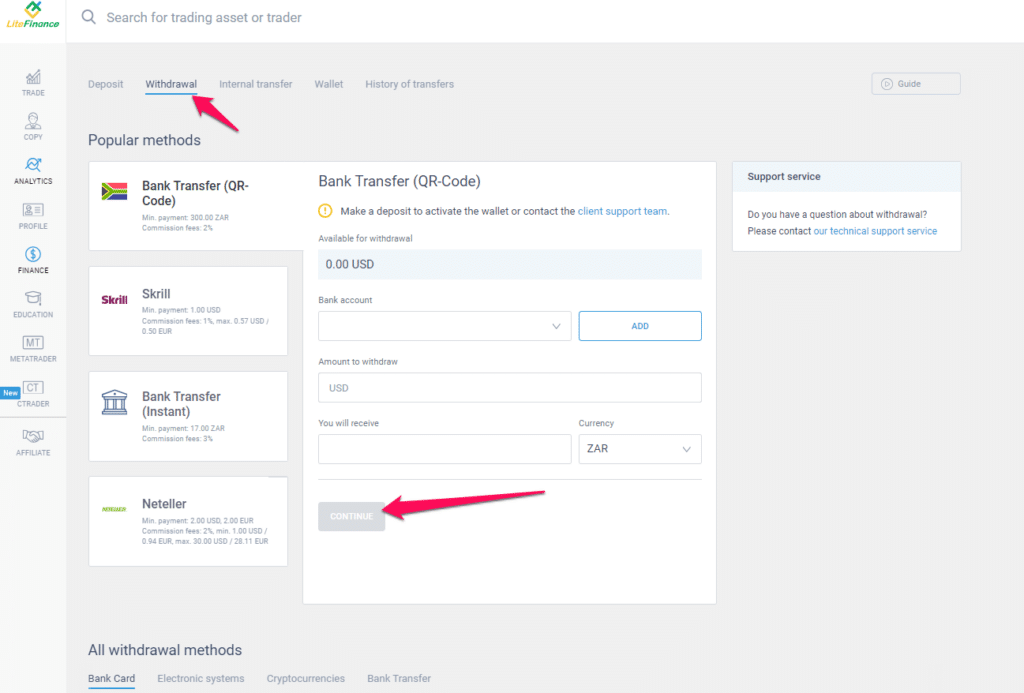

Fund Withdrawal Process

To withdraw funds from an account, Vietnamese traders can follow these steps:

Step 1. Sign in

Sign in to your account with your login information.

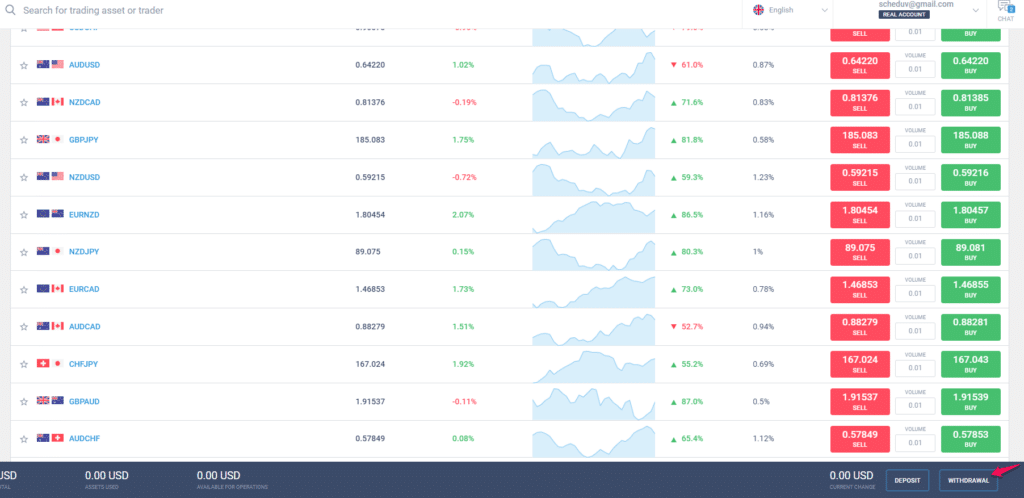

Step 2. “Withdrawal”

Go to your account’s “Withdrawal” section.

Step 3. Choose your preferred withdrawal method

Choose your preferred withdrawal method from the available options, which include credit/debit cards, bank transfers, and electronic wallets.

Enter the amount you wish to withdraw, and then follow LiteFinance’s instructions to complete the transaction.

As soon as the withdrawal is confirmed, the funds will be transferred to your chosen withdrawal method.

Can I withdraw to a different method than my deposit source?

No, they typically processes withdrawals using the same method for deposits for security reasons.

What measures does LiteFinance take to ensure withdrawal security?

To ensure the integrity and security of all withdrawal transactions, the broker employs advanced security protocols.

Education and Research

Education

Offers the following Educational Materials to Vietnamese traders:

- LiteFinance Webinars

- Forex Glossary

- Forex books

- Trading Strategies from professional traders

- LiteFinance Trader Reviews

- Demo Account

- FAQ section

Research and Trading Tool Comparison

| 🥇 LiteFinance | 🥈 FxPro | 🥉 InstaForex | |

| ➡️ Economic Calendar | Yes | Yes | Yes |

| ➡️ VPS | Yes | Yes | No |

| ➡️ AutoChartist | No | No | No |

| ➡️ Trading View | No | Yes | No |

| ➡️ Trading Central | No | Yes | No |

| ➡️ Market Analysis | Yes | Yes | Yes |

| ➡️ News Feed | Yes | Yes | Yes |

| ➡️ Blog | Yes | Yes | Yes |

also offers Vietnamese traders the following additional Research and Trading Tools:

- Economic Calendar

- Technical analysis

- Fundamental analysis

- Analytical materials offered by Claws & Horns

- Forex trading calculator

- Currency rates and quote charts

- Economic news

- Trader’s rating

- VPS

- Terminology and regulations

How can the research tools benefit my trading strategy?

Market research tools provide insights into market trends, allowing traders to make more informed decisions and fine-tune their trading strategies.

Does LiteFinance host any live webinars or workshops?

Yes, they frequently hosts webinars and workshops where traders can gain real-time insights and expert advice.

Bonuses and Promotions

The broker offers its clients a variety of bonuses and promotions. The 100% Forex deposit bonus is one of the current promotions, allowing traders to increase their deposits and receive additional trading capital.

Additionally, they offer individual deposit bonuses upon request. The company’s promotions and bonuses are intended to expand traders’ trading horizons and make Forex trading enjoyable. The broker always offers its customers withdrawable Forex bonuses with free profit withdrawals.

The broker offers other demo trading contests with real cash prizes for experienced traders and beginners. Vietnamese traders can participate in these contests on competitive demo accounts and with their real trading accounts.

The demo contests allow traders to trade on training Forex accounts, perfect their trading skills, and win real money prizes without opening a trading account.

Are the bonuses withdrawable?

Withdrawable bonuses are provided, allowing traders to access their bonus funds after meeting certain criteria.

Are there any special bonuses for new traders?

No, there are currently no sign-up bonuses. However, frequently offers special bonuses for new sign-ups, encouraging new traders to begin their trading journey.

How to open an Affiliate Account

To register an Affiliate Account, Vietnamese traders can follow these steps:

Step 1. Log in

Visit the LiteFinance website and navigate to the “Log In” area.

Step 2. Select the type of partnership program

- Select the type of partnership program you wish to participate in. The affiliate programs offered by LiteFinance include Revenue Share and CPS.

- Include your name, email address, and telephone number in the required fields.

- Accept the conditions and then submit your application.

- After your application has been approved, you will receive an email containing your affiliate link and additional information.

- Utilize your affiliate link to promote LiteFinance and earn commissions on the clients you refer.

Do I need trading experience to become an affiliate?

No, trading experience or market knowledge is not required to be an affiliate with LiteFinance.

What are the primary responsibilities of a affiliate?

Your primary role as a affiliate is to attract new customers who will engage in trading operations, and you will earn a portion of the profit from their transactions.

Affiliate Program Features

- A multi-tiered referral system. The affiliate programs are intended to help traders supplement their income by establishing a multi-level referral network.

- Commissions paid when replenishing and withdrawing funds are automatically reimbursed. This can be useful for traders who want to manage their funds easily.

- Its affiliate programs have competitive commission structures. The affiliate programs, offers a variety of commission structures, including a reward of 15 USD per lot traded by a referral plus 10% of a subpartner’s profits for the Revenue Share program. Vietnamese traders can also earn a commission through the CPS program, which pays 50 USD per referral and 10% of the profits of a subpartner.

- The ability to determine which referral channels are more effective and which cashback is best for traders. Vietnamese traders can create various partner programs with varying conditions to determine which referral channels are more effective and which cashback is best for them.

- A variety of affiliate programs with a multi-level system and cashback are available. Vietnamese traders can set up various types of partner programs, each with its own conditions and referrals sorted according to different criteria.

Are there multi-tiered benefits in the affiliate programs?

Yes, both the Rebate and the CostPerSale are multi-tiered, which means that referrals who bring in clients will become sub-partners, bringing in additional revenue for the affiliate.

What is the CPS program offered by LiteFinance?

The CostPerSale (CPS) program allows affiliates to earn up to $50 for each transaction made by a referral, provided certain conditions are met.

Min Deposit

USD 10 / 243449 VND

Regulators

CySEC

Trading Desk

MT4, MT5, Web-based

Crypto

Yes

Total Pairs

40

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Customer Support

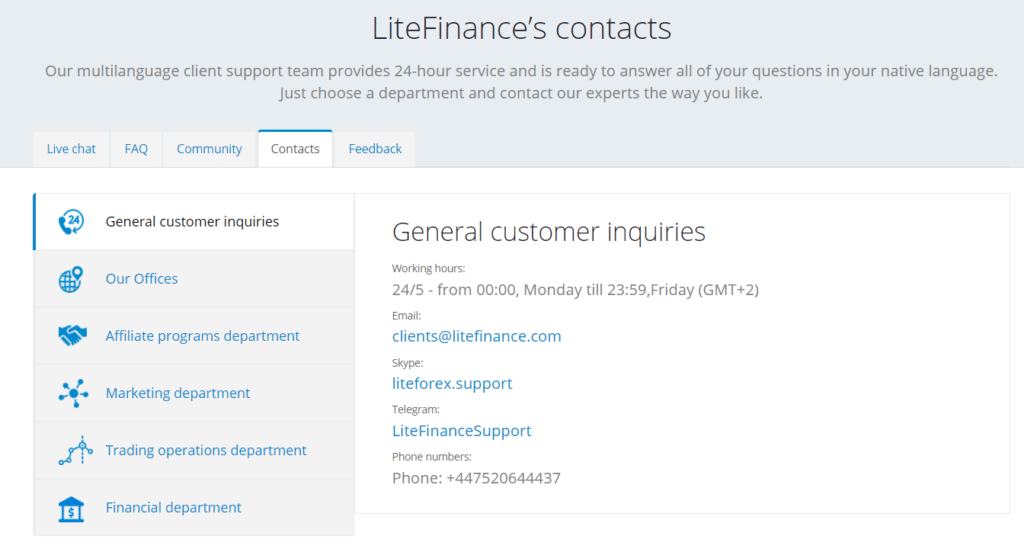

| Customer Support | LiteFinance Customer Support |

| ☎️ Telephone/WhatApp | +447520644437 |

| 🗺️ Website URL | https://www.litefinance.org/ |

| LiteFinanceSupport | |

| 🎓 Customer Service | 24/5 – from 00:00, Monday till 23:59,Friday (GMT+2) |

| 📍 Follow Us | Facebook |

Are there any self-help resources available for traders?

Yes, like most brokers, they will typically provide FAQs, guides, and tutorials for self-help on their platforms.

Does LiteFinance offer technical support for its trading platforms?

Yes, the broker provides technical support for platform-related questions.

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Corporate Social Responsibility

There is currently no information on LiteFinance’s Corporate Social Responsibility.

Our Verdict

Our final thoughts on LiteFinance are that it is a trustworthy forex broker that provides a diverse range of trading instruments, competitive trading conditions, and various account types to meet various trading requirements.

The trading platforms offered, which include MetaTrader 4, MetaTrader 5, cTrader, and the Trading App, are user-friendly and provide advanced charting and trading tools.

We also find that for traders who want to benefit from the expertise of professional traders, the broker also provides social trading and PAMM/MAM solutions.

The deposit and withdrawal methods offered, are convenient and offer quick processing times, and the broker’s customer support is responsive and helpful. The broker also provides a variety of bonuses and promotions, including a demo trading competition.

It should be noted, however, that the availability and terms of services may differ depending on the country and region.

For more information on current trading conditions and terms, Vietnamese traders should visit website or contact customer support. Furthermore, some clients have expressed dissatisfaction with the company’s work, and LiteFinance is not an educational organization.

You might also like: AvaTrade Review

You might also like: Exness Review

You might also like: FXCM Review

You might also like: XTB Review

You might also like: AAAFx Review

Pros and Cons

| ✔️ Pros | ❌ Cons |

| offers a range of markets and CFD instruments | There is a lack of transparency in pricing |

| Traders can use leverage up to 1:1000 on the CLASSIC and ECN Accounts | The costs on the CLASSIC account are 80% higher than the ECN account |

| There is a low $10 minimum deposit to register an account | There is a limited portfolio of instruments that can be traded |

| There are low commission fees on the ECN Account | There is no Tier-1 regulation or licensing |

| Traders can expect commission-free trading |

Conclusion

Our Review Methodology

For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker.

Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements.

Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Now it is your turn to participate:

- Do you have any prior experience with LiteFinance?

- What was the determining factor in your decision to engage with LiteFinance?

- Was it because of the minimum deposit, regulation, retail trading accounts, or other factors?

- Have you experienced issues with LiteFinance, such as difficulty withdrawing funds, inability to verify regulations, unresponsive customer support, etc.?

Regardless, please share your thoughts in the comments below.

Frequently Asked Questions

What is LiteFinance’s Client Profile?

The Client Profile is a secure area of the website that gives you access to all your main account operations.

Is LiteFinance Safe or a Scam?

They are a legitimate forex broker that CySEC regulates in Cyprus.

Is LiteFinance regulated?

Yes, they are regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 093/08.

What is the minimum deposit for LiteFinance?

The broker requires a minimum deposit of $10.

Does LiteFinance have Nasdaq 100?

Yes, they offer NASDAQ as a CFD on Indices. Furthermore, Vietnamese traders can also trade shares listed on this index.

What leverage does LiteFinance provide?

Leverage on CENT accounts is up to 1:200, and on CLASSIC and ECN accounts, it is up to 1:1000.

How long does it take to withdraw from LiteFinance?

The broker provides an automated withdrawal feature allowing traders to withdraw up to $100 daily within 24 hours. Withdrawals made through e-wallets and credit/debit cards are typically processed instantly, whereas bank transfers may take several hours or days.

How do I start copying trades on LiteFinance?

Copying trades is possible with there Social Trading platform.

What are the benefits of becoming a partner with LiteFinance?

You will be offered competitive terms as a partner under any of there forex trading affiliate programs.

Does LiteFinance have VIX 75?

The volatility index VIX is available as an analytical tool, but not for trading.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all Vietnamese investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Best Forex Brokers in Vietnam

Best Forex Brokers in Vietnam

Scam Forex Brokers in Vietnam

Scam Forex Brokers in Vietnam