4 Best Vietnamese Dong Forex Trading Accounts

The allure of the 4 Best Vietnamese Dong Forex Trading in the forex market is undeniable. As more brokers introduce VND accounts, trading has become more accessible for Vietnamese enthusiasts.

Join us as we explore the best brokers offering VND as their base currency and the advantages they bring to the table. In this in-depth guide, you’ll learn about the following:

- Introduction to Vietnamese Dong Forex Trading

- The Best VND Accounts in 2023

- Benefits of Trading the Vietnamese Dong

- Challenges and Risks in Vietnamese Dong Trading

- Choosing the Right Broker for Vietnamese Dong Trading

- Outlook for the Vietnamese Dong in Forex

- The Best Forex Brokers in Vietnam

And lots more…

So, if you’re ready to go “all in” with the 4 Best Vietnamese Dong Forex Trading Accounts in Vietnam…

Let’s dive right in…

- Lesche Duvenage

4 Best VND Accounts in Vietnam

| 🏛️ Broker | 👉 Open Account | ✔️ VND Forex Broker? | 💵 Vietnam Dong Deposits Allowed? | 💰 Minimum Deposit |

| Exness | 👉 Open Account | Yes | Yes | USD 10 / 245699 VND |

| JustMarkets | 👉 Open Account | Yes | Yes | USD 10 / 245699 VND |

| SuperForex | 👉 Open Account | Yes | Yes | $1/ 4505 VND |

| AZAforex | 👉 Open Account | Yes | Yes | $1/ 4505 VND |

Top 10 Forex Brokers

Broker

Rating

Regulators

Min Deposit

Leverage

Website

Top 10 Forex Brokers

Broker

Rating

Min Deposit

Leverage

Introduction to Vietnamese Dong Forex Trading

The Vietnamese Dong (VND) is becoming a more important player in forex trading. The Dong, Vietnam’s official currency, has seen significant changes in its value and trading volume, reflecting the country’s rapid economic growth and integration into the global economy.

Furthermore, forex trading with the Vietnamese Dong presents opportunities and challenges, so traders must understand its complexities.

4 Best VND Accounts in Vietnam

- Exness – Overall, User-Friendly Forex Broker for Beginner Traders.

- JustMarkets – Largest Welcome Bonus Broker

- SuperForex – Verified Broker with No Needed Starting Capital

- AZAFOREX – Best risk management tools

1. Exness

Exness has established a reputation as a reputable and transparent forex brokerage firm. Their Vietnamese Dong (VND) accounts stand out due to their extremely competitive spreads and low commission fees.

Investors also benefit from quick withdrawal options, which ensure the availability and accessibility of their financial resources.

Min Deposit

$10 / 244450 VND

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Furthermore, Exness offers a variety of cutting-edge trading platforms, including the popular MetaTrader 4 and MetaTrader 5, to accommodate traders of all levels of experience.

In addition, Vietnamese traders can rely on a dedicated customer support team to respond to their questions and concerns as soon as possible.

Overview

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | Yes |

| 💳 Minimum deposit (VND) | USD 10 / 244450 VND |

| 📈 Average spread from | From 0.0 pips |

| 📈 Maximum Leverage | Unlimited |

| 👥 Customer Support | No |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Exness is subject to stringent regulation by a number of credible groups, and it offers free virtual private server (VPS) hosting services as another perk. | Trading instruments are fairly limited in comparison to other companies, and there is a dearth of educational materials for newcomers. |

| In the foreign exchange market, Exness provides attractive leverage rates. | |

| In addition, Exness’ customer assistance is available 24/7. This guarantees that help will always be available. |

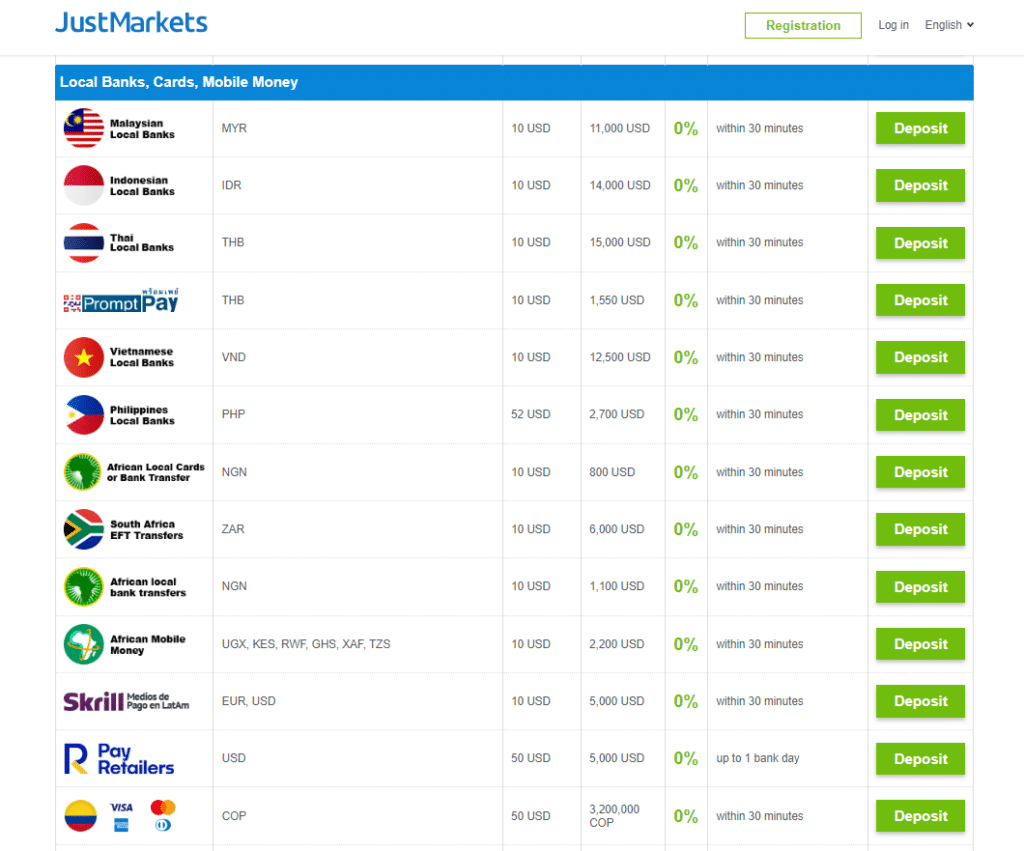

2. JustMarkets

JustMarkets is a well-known name in the forex industry praised for its user-friendly interface and wide range of trading instruments. Their VND accounts offer variable leverage, allowing traders to tailor their trading strategies to their risk tolerance.

Min Deposit

USD 10 / 245699 VND

Regulators

FSA, CySec

Trading Desk

Metatrader 4

Crypto

Yes

Total Pairs

240

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

JustMarkets’ comprehensive educational resources, which equip Vietnamese traders with the knowledge to navigate the forex market confidently, are one of its standout features.

The platform’s seamless integration with popular trading tools and indicators further improves the trading experience. Furthermore, JustMarkets prioritizes security, ensuring that traders’ funds are protected.

Overview

| Feature | Information |

| ⚖️ Regulation | Seychelles Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySec) |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | USD 10 / 245699 VND |

| 📈 Average spread from | N/A |

| 📈Trading Platform | MetaTrader 4 MetaTrader 5 JustMarkets App |

| 👥 Customer Support | 24/7 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| JustMarkets offers a huge range of deposit methods and withdrawal options including bank wire transfers, bank transfers, Skrill, Neteller, and more | There is a limited choice of trading instruments |

| Demo trading and Islamic Swap-Free Accounts are offered | Inactivity Fees may apply after following several days of dormancy |

| JustMarkets offers mobile trading through powerful mobile trading apps | The broker does not have regulation through a reputable and trusted regulatory body |

| JustMarkets offers competitive cryptocurrency spreads across crypto pairs including Bitcoin, Ethereum, and others | |

| JustMarkets’s non-trading fees are reasonable |

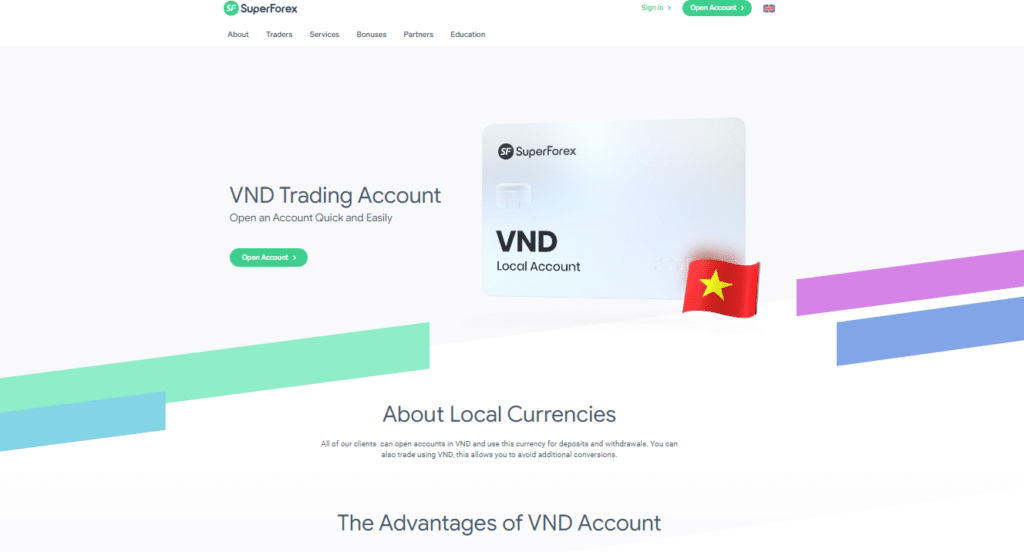

3. SuperForex

SuperForex consistently provides its clients with diverse trading accounts and services. The attractive bonuses and promotions tailored for account holders make SuperForex VND accounts particularly appealing.

Traders have access to daily market analysis, which provides them with expert insights to help them make sound decisions. The broker offers a variety of deposit and withdrawal methods for the Vietnamese Dong, which adds to the convenience.

Min Deposit

$1/ 4505 VND

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

Islamic Account

300

Yes

Trading Fees

Low

Account Activation

24 Hours

Furthermore, SuperForex recognizes and supports the shift toward mobile trading, allowing traders to execute trades on the go.

Overview

| Feature | Information |

| ⚖️ Regulation | IFSC |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | No |

| 💳 Minimum deposit (VND) | $1/ 4505 VND |

| 📈 Average spread from | Variable spread |

| 📈 Maximum Leverage | 1:1000 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| SuperForex offers user-friendly trading software | US clients are restricted from registering with SuperForex |

| There is a low minimum deposit requirement | |

| Traders have access to wide range of training resources | |

| SuperForex offers a range of useful trading tools | |

| There are social trading opportunities provided |

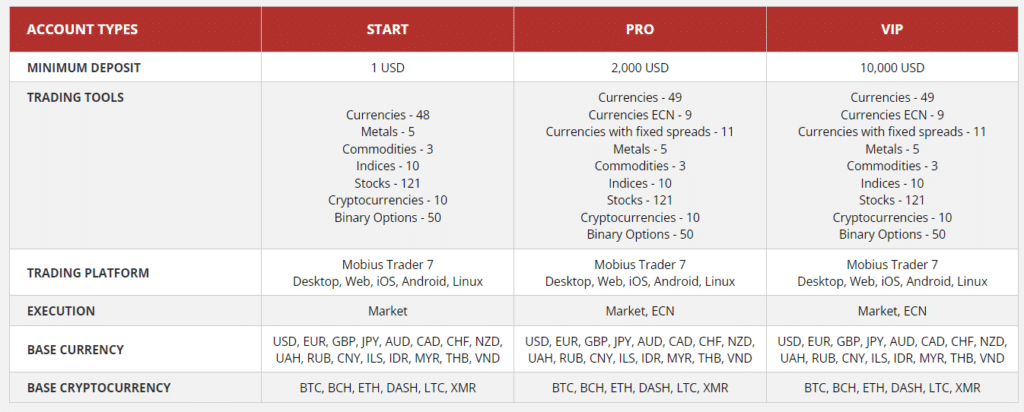

4. AZAFOREX

Despite being a newcomer to the forex market, AZAforex has quickly gained traction due to its innovative offerings and customer-first approach. Their VND accounts feature competitive spreads with no hidden fees, ensuring complete transaction transparency.

Min Deposit

$1/ 4505 VND

Regulators

None

Trading Desk

MOBIUS TRADER 7

Crypto

Yes

Total Pairs

131

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

AZAforex provides sophisticated risk management tools, allowing VND traders to limit potential losses. Personalized account management and advisory services distinguish the broker, providing traders with tailored solutions to meet their specific requirements.

Furthermore, AZAforex also holds regular webinars and training sessions, promoting continuous learning and growth for Vietnamese traders.

Overview

| Feature | Information |

| ⚖️ Regulation | Not regulated by any government agency |

| ⚖️ SBV Regulation | No |

| ✔️ Accepts Vietnam Traders? | Yes |

| 💳 Minimum deposit (VND) | $1/ 4505 VND |

| 📈 Average spread from | 0.0001 |

| 📈 Maximum Leverage | up to 1000:1 |

| 👥 Customer Support | 24/5 |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AZAforex offers user-friendly trading software | AZAforex is not Regulated |

| There is a low minimum deposit requirement | |

| Traders have access to wide range of training resources | |

| AZAforex offers a range of useful trading tools | |

| There are social trading opportunities provided |

Benefits of Trading the Vietnamese Dong

The Vietnamese Dong (VND) has risen to prominence in the forex market, reflecting Vietnam’s rapid economic growth and integration into the global financial system.

Trading the Vietnamese Dong provides numerous advantages, ranging from high liquidity to the potential for substantial profits in emerging markets. Here is a closer look at these benefits.

High Liquidity and Market Depth

Liquidity refers to the ease of buying or selling an asset without impacting its price significantly. The Vietnamese Dong is highly liquid due to increased trade and investment with global partners, allowing for large orders with minimal slippage and enhancing precision in trading.

Market depth, on the other hand, reveals supply and demand at various price levels. A deep market for the Vietnamese Dong indicates a balanced number of buy and sell orders, offering traders valuable insights into market sentiment, increasing transparency, and improving price movement forecasts.

Potential for Profit in Emerging Markets

Emerging markets like Vietnam, driven by rapid economic growth, reforms, and global integration, offer profitable prospects for traders.

The Vietnamese Dong, supported by the country’s robust GDP growth, rising exports, foreign investments, and participation in free trade agreements, has gained strength and stability.

These factors create opportunities for forex traders to benefit from the Dong’s appreciation and the optimistic outlook for the Vietnamese market.

Diversification for Forex Portfolios

Diversification, a key investment principle, involves spreading investments across various assets to lower risk. Including the Vietnamese Dong in forex portfolios enhances diversification, reducing potential losses from other currency pairs.

The Dong’s unique behavior, distinct from major currencies like the US Dollar, Euro, or Japanese Yen, shields against adverse movements in other pairs.

Additionally, this diversification allows traders to access the growth potential of Southeast Asia, counterbalancing potential declines in more established markets.

Challenges and Risks in Vietnamese Dong Trading

Engaging in currency trading, such as the Vietnamese Dong, comes with various challenges. The forex market’s inherent volatility, alongside distinctive traits of emerging market currencies, can expose traders to risks. Mastering these concerns is crucial when devising successful trading strategies.

Economic Factors Influencing the Dong’s Value

The value of the Vietnamese Dong, like the value of any other currency, is influenced by a variety of economic factors, including:

- Interest Rates: Monetary policy decisions made by the State Bank of Vietnam, particularly those concerning interest rates, can influence the Dong’s attractiveness to foreign investors. Higher interest rates can attract foreign capital, causing the Dong to appreciate and vice versa.

- Inflation: Excessive inflation can erode the purchasing power of the Dong, causing it to depreciate. Traders should monitor Vietnam’s inflationary trends and central bank policies aimed at containing inflation.

- Trade Balance: Vietnam’s exports and imports determine the Dong’s value. A trade surplus can cause the currency to appreciate, whereas a deficit can have the opposite effect.

- Foreign Direct Investment (FDI): Vietnam has been a magnet for FDI, particularly in manufacturing and real estate. While consistent FDI inflows can strengthen the Dong, sudden outflows can put the currency under pressure.

Political and Regulatory Considerations

Political stability and regulatory clarity are critical for any country’s economic health and, by extension, the strength of its currency:

- Political stability: Political unrest or uncertainty can deter foreign investment and result in capital outflows, lowering the value of the Dong.

- Regulatory Environment: Unpredictability in the forex market can be introduced by sudden changes in regulatory policies, particularly those relating to foreign exchange controls. Traders must be aware of any regulatory changes that may affect the trading conditions of the Dong.

Currency Volatility and Risk Management

The Vietnamese Dong, like other emerging market currencies, can be extremely volatile:

- Liquidity concerns: While the Dong has reasonable liquidity, it may not be as liquid as major currencies. This can result in wider bid-ask spreads and difficulties executing large trades without affecting the price.

- Risk Management: Given the inherent volatility of the Dong, traders must employ robust risk management strategies when trading it. It is part of setting stop-loss orders, diversifying trading positions, and staying informed about domestic and global events that could affect the currency.

- Market Sentiment: Global geopolitical events, economic data releases, and shifts in investor sentiment can cause the Dong’s value to fluctuate sharply and significantly.

Choosing the Right Broker for Vietnamese Dong Trading

Like any other currency, trading the Vietnamese Dong necessitates using a trustworthy and efficient broker.

Given the nuances of emerging market currencies, a trader’s broker of choice can significantly impact their success. Here is a comprehensive guide to assist traders in making informed decisions.

Criteria for Evaluating Brokers

- Security Protocols: The broker should use advanced security protocols such as encryption and two-factor authentication to protect traders’ data and funds.

- Currency Pairs Provided: While Vietnamese Dong may be the primary focus, it is advantageous if the broker provides diverse currency pairs. This enables traders to diversify their portfolios and mitigate risk.

- Regulation and Licensing: The first and most important criterion is that a reputable financial authority regulates the broker. Regulatory oversight ensures the broker follows stringent standards, protecting traders’ funds and ensuring fair trading practices.

- Leverage and Margin Requirements: Leverage levels vary between brokers. While increased leverage can increase profits, it also increases the possibility of losses. Understanding the broker’s margin requirements is critical to match the trader’s risk tolerance.

- Trading Platform: It is critical to have a user-friendly and robust trading platform. Real-time price feeds, advanced charting tools, and seamless execution can all help to improve the trading experience. MetaTrader 4 and MetaTrader 5 are popular platforms among forex traders.

- Customer Service: Effective customer service, particularly in the trader’s native language, can be invaluable. The prompt resolution of queries and issues ensures a smooth trading experience.

- Research and Educational Resources: Access to market analysis, research reports, webinars, and educational materials can benefit novice and experienced traders.

Future Outlook for the Vietnamese Dong in Forex

Given Vietnam’s impressive economic trajectory and increasing integration into the global financial system, the Vietnamese Dong (VND) has piqued the interest of many forex traders and analysts. Let us look at the Dong’s prospects in the forex market.

Economic Growth and Its Impact on the Dong

Vietnam has consistently demonstrated robust economic growth in recent years, emerging as one of Asia-Pacific’s fastest-growing economies. Several factors are driving this expansion:

- Manufacturing and exports: Vietnam has emerged as a manufacturing powerhouse, particularly in sectors such as electronics, textiles, and footwear. Consistent export growth has resulted in a positive trade balance, which can boost the value of the Dong.

- Foreign Direct Investment (FDI): Significant FDI has been attracted to the country, particularly in its Special Economic Zones. This infusion of foreign capital strengthens the economy and increases demand for the Dong.

- Tourism: The tourism industry in Vietnam has grown rapidly, quickly becoming a popular destination for visitors worldwide. Tourism revenue can have a positive impact on the Dong’s value.

Given these factors, the Dong will likely benefit as Vietnam’s economy grows and diversifies, potentially leading to an appreciation against other major currencies.

Global Trade Relations and the Vietnamese Dong

Vietnam’s strategic location and proactive approach to establishing trade partnerships have elevated it to the status of a major player in global trade:

- Trade Diversification: Vietnam has been diversifying its trading partners to reduce reliance on a single market. This diversification can serve as a hedge against global economic uncertainties, shielding the Dong from sharp fluctuations.

- Free Trade Agreements (FTAs): Vietnam is a signatory to several FTAs, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement (EVFTA). These agreements make it easier to access major markets, increasing exports and, as a result, the value of the Dong.

The Best Forex Brokers in Vietnam

In this article, we have listed the best brokers that offer forex trading to traders in Vietnam. We have further identified the brokers that offer additional services and solutions to Vietnamese traders.

Best MetaTrader 4 / MT4 Forex Broker in Vietnam

Min Deposit

USD 0 / 0 VND

Regulators

FSCA, CySEC, DFSA, FSA, CMA

Trading Desk

MT4, MT5, HFM Platform (Android & IOS)

Crypto

Yes

Total Pairs

50+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, HFM is the best MT4 Forex Broker in Vietnam. HFM’s MetaTrader 4 platform offers a diverse range of over 1,000 CFD instruments. Furthermore, HFM provides various tools and educational resources tailored to novice and seasoned traders, easing their trading journey.

Best MetaTrader 5 / MT5 Forex Broker in Vietnam

Min Deposit

USD 100 / 2434997 VND

Regulators

CySEC, FSCA, ASIC, FCA, FSC

Trading Desk

MT4, MT5, Proprietary Platform

Crypto

Yes

Total Pairs

57

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, Markets.com is the best MetaTrader 5 Forex Broker in Vietnam. Markets.com is a forward-thinking Forex broker focusing on technology to make Forex trading easier for everyone.

Markets.com’s MT5 platform allows traders to access over 2,200 markets with low spreads and no trading fees.

Best Forex Broker for beginners in Vietnam

Min Deposit

USD 100 / 2444503 VND

Regulators

ASIC, FSA, CBI, BVI, FSCA, FRSA, ISA

Trading Desk

MT4, MT5, Ava Social, Ava Protect, Trading Central

Crypto

Yes

Total Pairs

55+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, AvaTrade is the best forex broker for beginners in Vietnam. For those who are just getting started, AvaTrade has the best educational tools. AvaTrade also offers a demo account and helpful customer service.

Best Low Minimum Deposit Forex Broker in Vietnam

Min Deposit

USD 0 / 0 VND

Regulators

FSA, FCA, ASIC, DFSA

Trading Desk

MetaTrader 4

Crypto

Yes

Total Pairs

66

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, Axi is the best Low Minimum Deposit Broker in Vietnam. Traders in Vietnam open a trading account with Axi without regard for a minimum deposit. This is advantageous for traders who want to begin trading with a small investment.

Best ECN Forex Broker in Vietnam

Min Deposit

0 USD / 0 VND

Regulators

ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB

Trading Desk

MetaTrader 4, MetaTrader 5, cTrader and TradeView

Crypto

Yes

Total Pairs

60+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, Pepperstone is the best ECN Forex Broker in Vietnam. Spreads on the EUR/USD pair at Pepperstone start at an extremely low zero pip spread, setting it apart from the competition. Furthermore, Pepperstone’s prices are aggregated from top LPs in the industry.

Best Islamic / Swap-Free Forex Broker in Vietnam

Min Deposit

USD 10 / 244450 VND

Regulators

CySec, FCA

Trading Desk

No Trading Desk

Crypto

Yes

Total Pairs

47

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

eToro is Vietnam’s best Islamic / swap-free Forex Broker. eToro offers a diverse range of approximately 3,000 financial instruments across various asset classes, including equities, cryptocurrencies, and more.

Furthermore, eToro allows live accounts to be converted to an Islamic option, allowing them to trade halal instruments without incurring exchange fees.

Best Forex Trading App in Vietnam

Min Deposit

USD 0 / 0 VND

Regulators

SEC

Trading Desk

Web Trading Platform, Thinkorswim

Crypto

Yes

Total Pairs

–

Islamic Account

No

Trading Fees

Low

Account Activation

24 Hours

Overall, thinkorswim is the best Forex trading app in Vietnam. thinkorswim, TD Ameritrade’s exclusive mobile trading app, is available for iOS and Android users.

This mobile platform provides traders easy access to TD Ameritrade’s vast trading products, services, and educational resources.

Best Forex Rebates Broker

Min Deposit

USD 100 / 2434997 VND

Regulators

ASIC, FCA, CySEC

Trading Desk

MT4, MT5, TradingView

Crypto

Yes

Total Pairs

40

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, Eightcap is the Best Forex Rebates Broker in Vietnam. Eightcap offers forex rebates of up to 0.36 pips to traders who open a Standard or Raw account. Eightcap also offers monthly rebates and frequent real-time progress reports.

Best Lowest Spread Forex Broker in Vietnam

Min Deposit

$10 / 244450 VND

Regulators

CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA

Trading Desk

MetaTrader 4 and MetaTrader 5

Crypto

Yes

Total Pairs

107

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, Exness is the best, lowest spread Forex Broker in Vietnam. Exness is a well-known CFD broker that offers traders a wide range of instruments with spreads starting at 0 pips on popular instruments such as EUR/USD.

Best Nasdaq 100 Forex Broker in Vietnam

Min Deposit

$1/ 4505 VND

Regulators

IFSC

Trading Desk

Meta Trader 4

Crypto

Yes

Total Pairs

Islamic Account

300

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, SuperForex is the best Nasdaq 100 Forex Broker in Vietnam. With a minimum investment of 23,800 VND / 1 USD, SuperForex offers leverage of up to 1:3000 (1:5 on stocks and CFDs).

In addition to MT4, SuperForex offers its proprietary SuperForex App for iOS and Android users.

Best Volatility 75 / VIX 75 Forex Broker in Vietnam

Min Deposit

USD 25 / 612624 VND

Regulators

FCA, ASIC, CySEC, EFSA, JSC

Trading Desk

MT4, MT5, Admirals Mobile App

Crypto

Yes

Total Pairs

35+

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, Admirals is Vietnam’s best Volatility 75 / VIX 75 forex broker. Admirals is a reputable STP and ECN broker with a VIX of 75 and an extensive library of educational materials, tools, and trading platforms.

Best NDD Forex Broker in Vietnam

Min Deposit

USD 0 / 0 VND

Regulators

FMA, FSA

Trading Desk

MT4 and MT5

Crypto

Yes

Total Pairs

70

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, Blackbull Markets is the best NDD Forex Broker in Vietnam. Blackbull Markets is a popular choice among traders owing to its low commission rates, tight spreads, and sophisticated ECN technology.

Furthermore, Blackbull Markets provides Vietnamese traders access to a wide range of tradable instruments in a secure and transparent marketplace.

Best STP Forex Broker in Vietnam

Min Deposit

USD 100 / 2444503 VND

Regulators

CFT, NFA

Trading Desk

MT4

Crypto

Yes

Total Pairs

50

Islamic Account

Yes

Trading Fees

Low

Account Activation

24 Hours

Overall, FOREX.com is the best STP Forex Broker in Vietnam. The execution scorecard at FOREX.com ensures traders can expect fast, dependable trade execution speeds. Furthermore, FOREX.com is used by over 200,000 users worldwide to trade CFDs across markets.

Best Sign-up Bonus Broker in Vietnam

Min Deposit

USD 5 / 122225 VND

Regulators

IFSC, CySec, ASIC, FCA

Trading Desk

Desktop MT4 and MT5, Mobile MT4 and MT5, XM mobile app, Web platform

Crypto

Yes

Total Pairs

57

Islamic Account

Yes

Trading Fees

No (Just spread)

Account Activation

24 Hours

Overall, XM is the best sign-up bonus Broker in Vietnam. Traders who open a live trading account with XM can take advantage of several welcome bonuses, including a 30 USD no-deposit bonus.

You might also like: Best ECN Forex Brokers in Vietnam

You might also like: Best Forex Trading Apps in Vietnam

You might also like: Best Forex Trading Platforms in Vietnam

You might also like: Best CFD Forex Brokers in Vietnam

You might also like: Best Forex No-Deposit Bonus Brokers in Vietnam

Conclusion

According to our research, Vietnamese Dong (VND) trading accounts have gotten much attention in the forex world owing to Vietnam’s meteoric rise as an economic powerhouse in the Asia-Pacific region.

The allure of the Dong in the forex market is undeniable as the country maintains its robust economic growth trajectory, bolstered by strategic trade partnerships and a surge in foreign direct investments.

However, as with any trading endeavour, approaching VND trading with a well-informed strategy is critical. While promising, the Dong is vulnerable to the inherent volatility of emerging market currencies.

Our findings indicate that global geopolitical events, shifts in investor sentiment, and domestic economic policies can all impact its value. Therefore, we recommend that traders thoroughly understand Vietnam’s macroeconomic and microeconomic landscapes before investing.

Frequently Asked Questions

How do VND trading accounts work?

The Vietnamese Dong is used in VND trading accounts. This means that all deposits, trades, and fees are processed and displayed in VND, making it easier for Vietnamese investors to manage their accounts.

What are the benefits of brokers with VND trading accounts?

The advantages of brokers with VND trading accounts include easier management of investing accounts for Vietnamese traders, lower currency conversion fees, and easier deposits/withdrawals.

Can I withdraw my trading profits in VND?

Yes, if you have a VND trading account, you could withdraw your trading profits in VND.

Are VND trading accounts suitable for everyone?

VND trading accounts are ideal for Vietnamese traders because all transactions are processed in their home currency.

What are some top-rated brokers with VND accounts?

Top-rated brokers with VND accounts include Exness, JustMarkets, SuperForex, and AZAforex.

Addendum/Disclosure:

No matter how diligently we strive to maintain accuracy, the financial markets are volatile and could shift and change at any given time, even if the information supplied is correct at the time of going live.

Best Forex Brokers in Vietnam

Best Forex Brokers in Vietnam

Scam Forex Brokers in Vietnam

Scam Forex Brokers in Vietnam